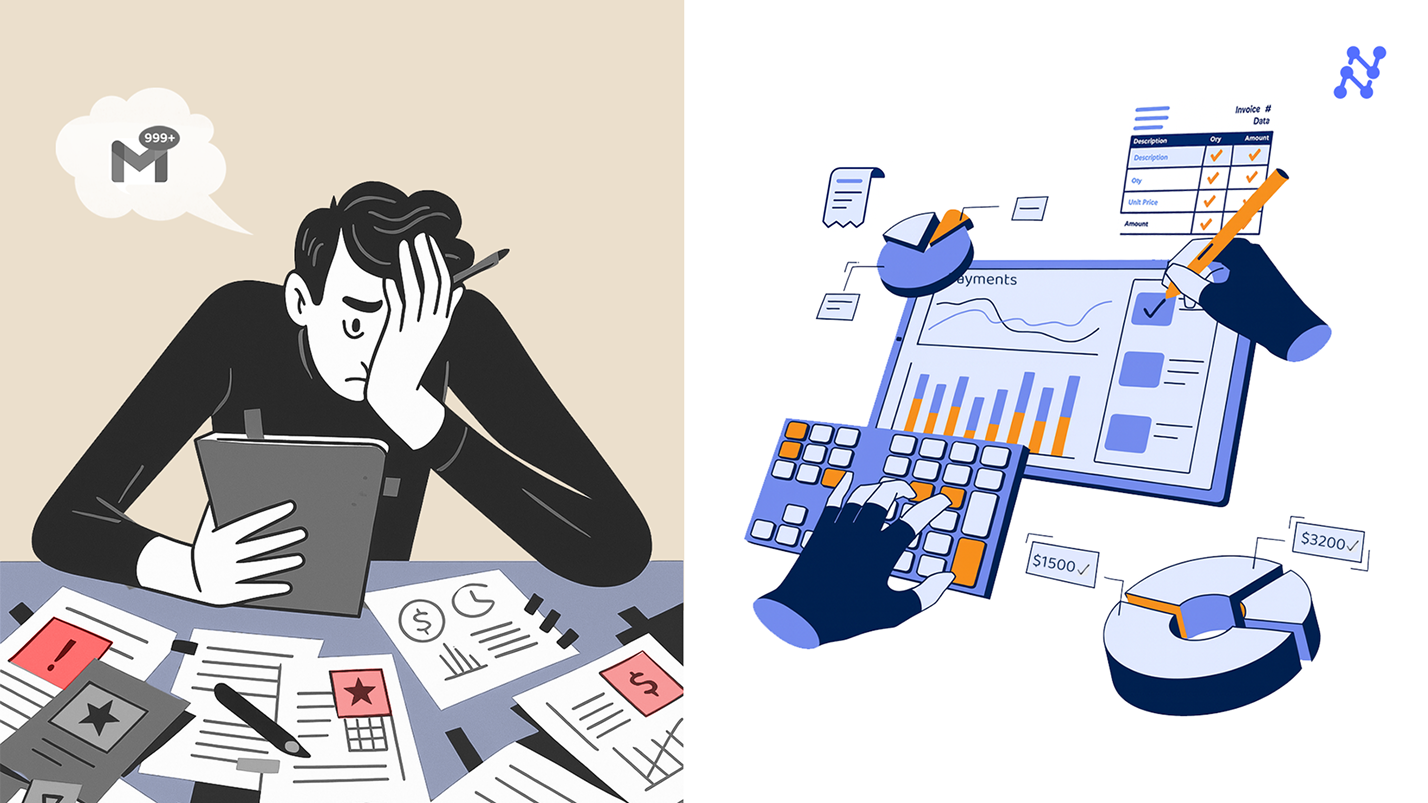

Introduction: The Invoice Chaos Problem

Picture a mid-sized company handling 1,000–2,000 invoices every month—roughly 250–500 invoices per week. On the surface, this doesn’t sound unmanageable. But at an average of 15–16 minutes per invoice, that volume quickly snowballs into 200–400 staff hours every month spent on repetitive tasks like data entry, coding, and chasing approvals. In practical terms, that’s the equivalent of one to two full-time employees dedicated solely to pushing paper instead of adding strategic value.

Beyond the labor drain, the financial impact is staggering. Studies show that manual invoice processing costs between $15 and $20 per invoice, depending on complexity and error rates. For a business processing 1,500 invoices per month—about 18,000 annually—that translates to $270,000–$360,000 per year spent on AP processing alone. Automation can reduce this cost to as little as $3 per invoice, unlocking $180,000–$300,000 in annual savings.

Time-to-payment is equally concerning. Manual workflows stretch invoice cycle times to 10.9–17.4 days on average, while best-in-class automated processes can shrink that to just 2.8–4 days. The result? Stronger vendor relationships, fewer late-payment penalties, and the ability to capture early-payment discounts.

Then there’s accuracy. Manual systems see error rates of ~1.6% per invoice, with mistakes like duplicate payments compounding over time. Intelligent automation reduces errors by up to 80%, dramatically lowering the cost of rework and compliance risk.

For finance leaders, these numbers highlight a hard truth: manual invoice management is not just inefficient—it’s a silent tax on growth.

This is where invoice automation software enters the picture—transforming invoice management from a slow, manual burden into a streamlined, intelligent process. An automated invoice processing system turns this chaos into clarity.

What is Invoice Automation Software?

At its core, invoice processing automation software is designed to streamline the entire invoice-to-pay workflow. Instead of accounts payable (AP) teams manually entering line items, verifying purchase orders, routing documents for approval, and scheduling payments, automation software digitizes each step—from invoice capture to validation, approval routing, and payment execution.

The foundation of invoice automation is data capture — done in seconds, not minutes —extracting key information such as vendor name, invoice number, line items, tax details, and payment terms from documents. Early systems relied heavily on optical character recognition (OCR), which converts scanned text into machine-readable formats.

But traditional OCR tools are rigid: they require pre-built templates for each invoice format, and even minor changes (like a vendor updating their layout) can break extraction accuracy.

This is where AI-first approaches—often called Intelligent Document Processing (IDP)—fundamentally change the game. Unlike template-based OCR, AI-driven systems learn patterns across invoices, adapt to new formats dynamically, and continuously improve with usage. This allows them to handle invoices from thousands of vendors without requiring constant template maintenance.

Why does this distinction matter? Because at scale, template fragility becomes a bottleneck. A mid-sized company might process invoices from hundreds of suppliers, while enterprises manage tens of thousands. Each vendor may have multiple formats, currencies, or tax codes. In template-based OCR systems, every variation needs manual configuration. With AI-first platforms, invoices are captured accurately regardless of format, enabling AP teams to spend time on exceptions and approvals instead of fixing broken templates. Unlike outdated template-based OCR, these invoice automation solutions ensure accuracy at scale.

Simply put, invoice automation software—especially when powered by AI-first capture—turns a fragmented, error-prone process into a seamless, touchless workflow, allowing businesses to reduce costs, improve accuracy, and scale operations without scaling headcount.

But beyond efficiency, why does this matter so much for businesses today? The answer lies in the very real savings and competitive advantages automation delivers.

Why Businesses Need Invoice Automation

Even in organizations that have digitized other finance functions, AP often remains stubbornly manual—without an automated invoice processing system to streamline workflows. As we saw earlier, processing invoices manually consumes hundreds of staff hours, costs upwards of $15 per invoice, and introduces error risks that undermine accuracy and compliance. Add to that scattered invoices across inboxes and filing cabinets, and the result is poor cash flow visibility and lack of real-time control.

The ripple effects are significant. Companies miss out on early-payment discounts, absorb late fees, struggle with compliance, and strain relationships with vendors. What should be a straightforward operational process becomes a bottleneck that drains working capital and productivity.

Invoice automation flips this equation. By digitizing capture, validation, and approval workflows, organizations dramatically reduce cycle times, cut costs, and improve accuracy. More importantly, automation frees finance teams from repetitive data entry, allowing them to focus on analysis, planning, and supplier strategy.

The benefits are clear:

- Cost savings: Automation reduces invoice costs by more than 80%, unlocking six-figure savings annually for mid-sized firms.Speed: Cycle times fall from weeks to just a few days, helping companies avoid late fees and capture early-payment discounts.Accuracy: Error rates drop dramatically, cutting duplicate payments and manual rework.Capacity: Finance teams free up the equivalent of 1–2 FTEs annually to focus on higher-value tasks.

📌 Case Study: Asian Paints + Nanonets

One of Asia’s largest paint manufacturers adopted an automatic invoice processing solution to tackle this burden. With Nanonets, they cut invoice processing time from five minutes to ~30 seconds per document—a 90% reduction. By automating extraction and routing into SAP, the company saved 192 hours per month (~10 FTE days) and positioned itself to manage 22,000+ vendors with minimal manual intervention.

📌 Case Study: SaltPay + Nanonets

SaltPay, a fast-growing payments provider, manages over 100,000 vendors. Manual processing was slowing down growth. By integrating Nanonets with SAP, SaltPay achieved near-100% accuracy in data capture and realized 99% time savings compared to manual workflows. Finance teams shifted from invoice coding to supplier management and strategic finance projects, strengthening both throughput and vendor relationships.

In short: automation transforms AP from a costly liability into a strategic enabler of cash flow visibility, compliance, and supplier trust.

Must-Have Features of the Best Invoice Automation Software

Once you understand why invoice automation is critical, the next question is obvious: what features separate the best platforms from the rest?

Not all solutions deliver true automation; some still rely heavily on templates, manual intervention, or clunky integrations. The right software should combine intelligence, flexibility, and scalability to fit your business today—and grow with you tomorrow.

These are the non-negotiable features every invoice automation solution should provide:

1. AI-First Data Capture

At the heart of invoice automation lies accurate data extraction. Legacy OCR systems require templates for each invoice layout, making them fragile and maintenance-heavy. A small change in a vendor’s format can break extraction and flood AP teams with exceptions. By contrast, AI-first systems learn invoice layouts without templates. They adapt to new formats dynamically, ensuring high accuracy across thousands of vendors and document types. This is critical for scaling without creating new back-office burdens.

2. Business Rule Validations

Capturing data is only the first step. Best-in-class systems apply business rule validations automatically, ensuring invoices comply with organizational and regulatory requirements before they ever hit approval queues. Examples include:

- 3-way matching (invoice vs. purchase order vs. goods receipt).Vendor compliance checks, such as validating supplier bank details against master records.Duplicate detection, flagging invoices with the same number or amount already processed.Tax and VAT compliance, automatically verifying rates and jurisdiction-specific rules.Threshold alerts, flagging invoices above a set amount for additional approval.These rules not only reduce exceptions but also safeguard against fraud and compliance risks.

3. Flexible Approval Workflows

AP processes are rarely linear. Invoices may need multiple reviewers across departments, special handling based on value, or emergency escalation when deadlines loom. Look for platforms with configurable approval workflows that can:

- Route invoices automatically by vendor, department, or spend category.Apply role-based and conditional approvals (e.g., invoices >$10K routed to the CFO).Escalate overdue approvals to backup reviewers.Allow mobile approvals, enabling busy executives to approve on the go.Support delegation when an approver is out of office.By automating these workflows, companies eliminate bottlenecks, reduce back-and-forth emails, and keep payment cycles on track.

4. ERP & Accounting Integrations in Invoice Processing Automation Software

Automation only delivers full value if it connects seamlessly to your finance stack. Leading platforms offer native integrations with ERP and accounting systems such as QuickBooks, NetSuite, SAP, and Oracle. This ensures that invoice data, approvals, and payment status flow automatically into your system of record—removing duplicate entry and reducing reconciliation headaches.

5. Analytics & Reporting

Top-tier platforms go beyond processing to deliver visibility and control. Dashboards should track KPIs such as:

- Average cycle time per invoice.Exception rates and bottlenecks.Spend by vendor or category.Percentage of invoices captured and approved touchlessly.

These insights help CFOs and controllers optimize working capital, identify process inefficiencies, and negotiate better vendor terms.

6.Scalability & User Experience

Finally, the platform should grow with your business. That means handling volume spikes gracefully (think quarter-end invoice surges), supporting multi-entity or global structures, and maintaining high accuracy even as complexity increases. Just as important: a clean, intuitive interface. If AP staff find the system clunky, adoption will lag and the value of automation will erode. A strong user experience ensures teams embrace the tool instead of working around it.

Best Invoice Automation Software in 2025

Understanding the must-have features is one thing; finding the right solution is another. The market for invoice automation has exploded, with dozens of vendors promising speed, accuracy, and integration. But not every platform delivers the same value. Some excel at end-to-end AP automation, while others focus on niche strengths like AI-first capture or small business simplicity.

To help you navigate the options, we’ve grouped the leading invoice processing automation software into four categories—each suited to a different business profile:

- End-to-End AP Automation for companies seeking comprehensive control from invoice to payment.Small Business Tools for firms that want affordability and ease of use.Enterprise ERP Solutions for large organizations needing deep system integration.AI-First Extraction Engines for businesses looking to modernize capture without overhauling their ERP stack.

In the sections that follow, we’ll break down each vendor by target use case, key features, pricing, pros and cons, integrations, and ideal customer profile.

📊 Automated Invoice Processing Software Landscape at a Glance

| Category | Vendors | Strengths |

|---|---|---|

| End-to-End AP Automation | Tipalti, Stampli | Full AP suite + vendor/ERP integration |

| Small Business Friendly | QuickBooks Bill Pay, Melio | Low-friction, cost-effective automation |

| Enterprise ERP Workflows | SAP Concur, Coupa | Deep enterprise control, spend visibility |

| AI-First Invoice Capture | Nanonets, Rossum | Template-free, intelligent extraction layers |

Now let’s take a closer look at each of these solutions to see how they compare in practice.

a. Best for End-to-End AP Automation (Tipalti & Stampli)

Tipalti

- Target use case: Businesses needing full-spectrum AP—from invoice capture to global payouts—especially where compliance and scalability matter.Key features: AI-driven invoice capture; 2-/3-way matching; supplier self-onboarding and built-in tax compliance; global mass payments; real-time reconciliation; spend visibility tools.Pricing: SaaS plans starting at $99/month; enterprise pricing on request.Pros: Automates global payables; integrates broadly; strong controls.Cons: May be overkill for small teams; complexity can be a barrier.Integrations: NetSuite; QuickBooks; Acumatica; Dynamics; Sage; SAP Business One; Xero; SAP S/4HANA; Workday; Infor; and popular performance marketing platforms.Ideal customer: Mid-market to enterprise firms managing high-volume, cross-border payables.

Stampli

- Target use case: Teams needing quick AP workflow upgrades that don’t disrupt existing ERPs, with heavy emphasis on collaboration and AI assistance.Key features: AI assistant (“Billy the Bot”); seamless QuickBooks integration; 2-/3-way PO matching; vendor portal; unified communication; integrated payments including domestic and international options.Pricing: Bundled licensing tied to invoice volume and user roles; connector fees may apply.Pros: Deploys fast; an "AP-first" solution that integrates with, rather than replaces, a company's existing ERP - reducing friction in change management.Cons: Connector fees and bundled pricing may be opaque for small teams.Integrations: QuickBooks; NetSuite; Xero; Sage Intacct; Microsoft Dynamics; SAP; Oracle; workflow tools (Slack, Teams); and over 70 other systems.Ideal customer: Mid-market finance teams wanting AP automation without ERP rip-and-replace.

b. Best for Small Businesses (QuickBooks Bill Pay & Melio)

QuickBooks Bill Pay

- Target use case: SMBs embedded within the QuickBooks ecosystem (QuickBooks Online or QuickBooks Desktop) seeking basic yet reliable bill payment automation.Key features: Invoice capture via upload or email using OCR; batch payments; automated purchase order matching; basic approval workflows; supplier self-service portals; supports ACH/credit/check options (international payments are limited); provides tools for 1099 compliance for US vendors.Pricing: Native to QuickBooks subscriptions; available as an add-on.Pros: Low friction; aligned with bookkeeping workflows.Cons: Limited advanced workflow or AP analytics beyond Small Business needs; lacks the robust, customizable 3-way matching that is standard in more advanced AP automation platforms; approval workflows are less flexible than those offered by dedicated solutions.Integrations: Built-in with QuickBooks Online/Advanced.Ideal customer: Small businesses using QuickBooks with light-to-moderate AP volume.

Melio

- Target use case: Very small businesses needing intuitive payables and receivables in one, budgeting simplicity with flexibility on fees.Key features: Seamless QuickBooks Online sync; free for standard ACH transactions, with monthly fees for premium plans; extended pay terms; simple vendor onboarding; encrypted data and compliance.Pricing: Free for standard use; fees apply for expedited or credit-based payments.Pros: Friendly UX; affordable; extended liquidity options.Cons: Limited P2P or procurement features.Integrations: QuickBooks Online; QuickBooks Desktop; Xero; and FreshBooks, with an open API for custom integrations.Ideal customer: Micro-businesses or solo operators seeking pay-on-demand flexibility.

c. Best for Enterprise ERP Workflows (SAP Concur & Coupa)

SAP Concur

- Target use case: Large and global enterprises combining travel, expense, and invoice management under one compliant ecosystem.Key features: Automated invoice capture (paper, email, fax) with ML/OCR; mobile expense/receipt matching; real-time spend visibility; AI fraud detection and policy enforcement (Joule AI Copilot); comprehensive analytics.Pricing: Custom pricing (~$9/user/month baseline, with quotes scaling up); large footprints likely in five-figure SaaS budgets.Pros: Deep coverage across T&E, invoicing, compliance; powerful analytics; ability to enforce policies and provide a single source of truth for all employee-initiated spend.Cons: Steeper learning curve; clunky UX; expensive setup and scaling.Integrations: NetSuite; SAP ERP (S/4HANA, ECC); Oracle; Microsoft; QuickBooks; HR systems; reporting tools; and a wide ecosystem of hundreds of third-party apps.Ideal customer: Global enterprises needing end-to-end spend visibility and governance.

Coupa

- Target use case: Enterprises looking for advanced invoice/PO capabilities, AI validation, vendor collaboration, and rich business spend management (procurement, invoicing, payments, and supply chain management).Key features: AI-powered invoice validation; 2- and 3-way matching; e-invoicing; supplier self-service; multi-currency/multi-country handling; optimized payment scheduling; mobile access; dashboards.Pricing: Quote-based, often in ~$90K/year mid-tier range.Pros: Strong AI and fraud tools; unified view of all spend, powered by AI to automate tasks, improve compliance, and drive savings; scalable.Cons: High cost; supplier adoption may require extra change management.Integrations: Deep ERP connectors with SAP; Oracle; plus APIs for custom use.Ideal customer: Large, often global, enterprise matrixed organizations needing full-suite spend intelligence.

d. Best for AI-First Invoice Extraction (Nanonets & Rossum)

Nanonets

- Target use case: Businesses seeking a nimble, AI-native (Intelligent Document Processing) capture layer that can inject automation into existing systems.Key features: Template-free AI OCR customization; integrations with QuickBooks, Xero, and other accounting and ERP systems; highly accurate field extraction; cost-effective for high volumes of invoices; automates 2- and 3-way matching and flags anomalies or duplicate invoices; offers features that support compliance and audit readiness.Pricing: Flexible, usage-based pricing with transparent costs.Pros: Fast ROI; flexible deployment; accuracy gains.Cons: Requires pairing with workflows or ERP to complete automation; not a full-suite AP automation or ERP system with native payment and reconciliation capabilities.Integrations: Native integrations with popular accounting software (QuickBooks, Xero, FreshBooks) and robust API connectors for deeper ERP integration (NetSuite, SAP, etc.).Ideal customer: Mid-sized firms and enterprises needing smarter capture without full suite commitment.

Rossum

- Target use case: Organizations that already have AP workflows but need more resilient, AI-based invoice data capture capabilities.Key features: AI-driven document understanding; customizable templates; validation rules; cloud extraction; real-time dashboards.Pricing: Quote-based, with tiered plans starting at a high price point ($18,000 per year).Pros: Best-in-class capture; easy integration with existing DMS/ERP.Cons: Limited end-to-end AP capabilities; must be layered into existing stack.Integrations: API-friendly with native integrations for major ERPs (SAP, Oracle, Coupa) and a wide range of accounting and automation tools.Ideal customer: Teams wanting best-in-class capture in place of brittle OCR systems.

How to Choose the Right Invoice Automation Software

With so many options on the market, the question isn’t whether to automate invoices—it’s which platform best fits your business needs. Choosing the right solution requires balancing scale, complexity, and organizational priorities.

Here’s a step-by-step framework to guide evaluation:

Step 1: Assess Invoice Volume and Workflow Complexity

The size of your AP workload is the single most important determinant. A company processing 200 invoices per month has very different needs than one handling 20,000+ invoices globally. Consider not just volume, but also workflow complexity: multi-entity structures, global vendors, tax/VAT rules, or multi-level approval chains.

Step 2: Map to Vendor Categories

Map your workload to the right invoice automation solution (as summarized in the previous section):

- Small Business Tools → Ideal if you process fewer than 500 invoices/month and want low-cost simplicity.AI-First or Mid-Market Suites → Best fit for firms handling 1,000–2,000 invoices/month and needing workflow automation with ERP integration.Enterprise ERP/Global Suites → Necessary for organizations processing 10,000+ invoices/month, with complex compliance and multi-entity requirements.

Step 3: Consider Persona-Based Priorities

Different stakeholders weigh different factors:

- CFO → Cash visibility, compliance, auditability, ROI.Head of Operations → Efficiency, scalability, process resilience.AP Manager → Usability, accuracy, ease of onboarding staff.

A successful choice satisfies all three lenses, not just one.

Step 4: Apply a Quick Evaluation Checklist

Before issuing RFPs or scheduling demos, use this five-point filter:

- Volume fit: Can it handle your current and future invoice load?Integrations: Does it natively connect to your ERP/accounting system?Approval workflows: Are they configurable to your structure?Compliance & security: Does it meet SOC 2, GDPR, SOX, and audit requirements?Budget alignment: Is pricing transparent, and does ROI justify the spend?

In short: choosing invoice automation software is about fit, not flash. By mapping your invoice volume, aligning with vendor categories, considering persona-driven needs, and applying a structured checklist, you can confidently narrow the field to a shortlist that will deliver impact today and scale tomorrow.

Conclusion: Automating Today, Future-Proofing Finance

Invoice automation is no longer just about reducing data entry. The technology is evolving rapidly, and the next wave of innovation is set to redefine how accounts payable functions within modern finance organizations.

Emerging Trends to Watch

- Touchless AP → The holy grail is a fully automated, “straight-through” process where invoices move from capture to validation, approval, and payment with zero human intervention. Early adopters already report significant cycle time reductions, and the expectation is that touchless AP will become the standard rather than the exception.Predictive Analytics → With historical invoice data feeding into AI models, businesses will gain the ability to forecast spend, anticipate cash flow requirements, and identify anomalies before they become problems. This shifts AP from a reactive function to a forward-looking partner in financial strategy.AI-Led Fraud Detection → Fraudulent invoices, duplicate submissions, and suspicious vendor activity remain a persistent risk. Emerging platforms are embedding machine learning to flag these anomalies in real time, reducing financial leakage and strengthening compliance.AI Agents in Finance → Traditional automation tools like RPA were built for repetitive, rules-based tasks, but they break down when workflows involve exceptions or context. The next leap is AI agents—autonomous, goal-driven systems that can reason, adapt, and collaborate with humans. In AP, these agents can negotiate exceptions with suppliers, learn new vendor rules dynamically, route invoices intelligently, and trigger downstream ERP actions without explicit prompts. Early adopters report 65–75% reductions in manual intervention, with agents taking over approvals, compliance checks, and anomaly detection—making AP not just faster, but smarter and more resilient.

Strategic Impact on Finance

As automation matures, accounts payable will no longer be seen as a cost center. Instead, it will become a finance intelligence hub—a source of real-time insights into cash flow, vendor risk, and working capital trends. The biggest shift is cultural: AP teams move from chasing invoices to influencing strategic finance decisions, from liquidity planning to supplier negotiations.

AI agents will accelerate this transition. Unlike static workflows, they can learn from context, reason through exceptions, and interact directly with both systems and people. This means AP teams are supported by autonomous assistants that not only process invoices, but also optimize working capital, monitor compliance continuously, and surface insights proactively.

Key Takeaways

- Cost savings: Mid-market firms can free up 200+ hours and save $180K–$300K annually.Compliance & accuracy: AI-driven automation reduces error rates by up to 80% and strengthens audit readiness.Future trends: Touchless AP, predictive analytics, AI-driven fraud detection, and finance-focused AI agents are moving from experimental to standard.Strategic growth: Invoice automation—powered increasingly by AI agents—is the bridge from back-office efficiency to finance-led decision-making.

Closing Thought: Invoice automation is no longer a “nice-to-have”—it’s an operational necessity. Companies that adopt AI-first platforms today position themselves not only to cut costs, but to build the finance function of the future. The next wave will be driven by AI agents—autonomous assistants that can handle exceptions, optimize cash flow, and proactively surface insights. The question isn’t if you should adopt automated invoice processing software, but how quickly you can put AI agents to work for your finance team.

Frequently Asked Questions about Invoice Automation

1. What is invoice automation and how does it differ from manual processing?

Invoice automation (or automated invoice processing software) uses AI to capture, validate, route, and pay invoices—cutting costs, speeding up cycle times, and reducing errors. Unlike manual processing, which relies on data entry and spreadsheets, automation provides touchless workflows that scale with your business.

2. How does AI-first invoice capture outperform traditional OCR?

AI-first capture doesn’t require rigid templates. It learns invoice patterns dynamically, adapts to layout changes, and maintains accuracy across thousands of vendor formats. Traditional OCR often fails when vendors update formats—leading to exceptions and manual fixes.

3. Can invoice automation handle multiple currencies and tax systems?

Yes. Most invoice automation solutions support multi-currency processing and local tax/VAT rules, making them effective for global operations. This ensures compliance and accuracy across jurisdictions while minimizing errors from manual entry.

4. What kind of time and cost ROI can mid-sized businesses expect?

For companies processing 1,000–2,000 invoices/month, automation can free up 200–400 staff hours monthly, cut costs from $15–20 per invoice down to ~$3, and unlock $180K–$300K in annual savings.

5. How long does implementation typically take?

Implementation depends on complexity and integrations, but most businesses go live in a few weeks to a few months. Many platforms include vendor support and pre-built connectors to accelerate rollout.

6. Will my team still need manual oversight after automating invoices?

Yes. Automation handles the majority of invoices, but exceptions—such as disputes, missing POs, or unusual spend—still require human review. This means AP teams spend less time on data entry and more time on strategy.

7. What size of business benefits most from invoice automation?

All business sizes benefit. Small firms gain efficiency and error reduction, mid-sized companies see the fastest ROI (200+ hours and six-figure savings annually), and large enterprises gain global compliance, scalability, and spend visibility.

8. How does automation improve vendor relationships?

By reducing delays and errors, automation ensures faster, more accurate payments. Supplier portals and better visibility improve communication, while timely payments strengthen trust and allow businesses to capture early-payment discounts.