Since 2020, fintech Block (No. 179 on the Fortune 500) has held bitcoin as part of its corporate assets. Beyond its merchant services and lending tools through Square, and investing features for Cash App users, the company recently announced Square Bitcoin—a fully integrated bitcoin payments and wallet solution launching Nov. 10 for businesses of all sizes.

“We can help turn our Square sellers into corporate bitcoin holding companies as well,” Amrita Ahuja, Block’s COO and CFO, told me.

I spoke with Ahuja, along with Neil Jorgensen, Block’s treasury corporate lead, and Nikhil Dixit, head of financial planning and analysis, about how the company approaches bitcoin.

From experiment to strategy

Block’s bitcoin journey began with customer demand. In 2018, Cash App launched the ability for users to buy, hold, and sell bitcoin. Since then, more than 20 million Cash App actives have traded over $58 billion worth of bitcoin, Ahuja said.

In 2020, Block made its first corporate bitcoin purchase—$50 million, less than 1% of total assets—mainly as a learning exercise, she said. The following year, Block expanded its holdings with an additional $170 million investment in bitcoin, and in 2024 adopted a dollar-cost averaging strategy, reinvesting 10% of monthly gross profit from bitcoin products, Ahuja explained.

Block has also open-sourced its bitcoin frameworks and white papers and launched a real-time bitcoin dashboard showing its holdings and price data. As of the second quarter of this year, Block held 8,692 bitcoin on its balance sheet.

Taking the long view

Many finance leaders remain cautious, viewing bitcoin as too volatile compared to traditional assets. Jorgensen acknowledges that perception.

Some see it as volatile and worry about shareholder reaction, he said. “But we don’t leverage bitcoin as our operating capital—we don’t ride an emotional roller coaster with it,” he added.

Block positions bitcoin as a long-term investment, guided by clear risk parameters, according to the leaders.

“Start small,” Ahuja advised. “Whether it’s a $1 cost-averaging program or a small one-time purchase, build understanding first.”

“Having a long-term view is very helpful,” Jorgensen said. “We’ve always held a very long-term view, so it gives us confidence. We sleep well at night.”

Ahuja noted that institutional infrastructure for bitcoin—custodians, liquidity providers, and banks—has matured significantly over the past several years, creating greater stability.

Back in 2020, when bitcoin traded around $10,000, investors saw it as purely speculative, Dixit said, who previously led investor relations at Block. The challenge at the time was explaining that Block’s bitcoin strategy was a principled, calculated risk representing a small slice of its portfolio, he explained. “Today, that sentiment has shifted dramatically,” he said.

Looking ahead

Block’s leaders emphasize the importance of tracking regulation and treating bitcoin like any other strategic asset.

“AI is changing almost every vector we can see,” Jorgensen said. “We want to be at the forefront—and we see bitcoin as part of that future.”

Ahuja’s advice to peers: Treat bitcoin as a strategic investment and be ready to explain your rationale in the context of your business, liquidity, and risk appetite.

Sheryl Estrada

sheryl.estrada@fortune.com

***Upcoming Event: Join us for our next Emerging CFO webinar, Optimizing for a Human-Machine Workforce, presented in partnership with Workday, on Nov. 13 from 11 a.m. to 12 p.m. ET. Speakers include: Nitin Mittal, principal, global AI leader at Deloitte and Thadd Stricker, CFO of INRIX.

We’ll explore how leading CFOs are rethinking the future of work in the age of agentic AI—including when to deploy AI agents to accelerate automation, how to balance ROI tradeoffs between human and digital talent, and the upskilling strategies CFOs are applying to optimize their workforces for the future.

You can register here. Email us at CFOCollaborative@Fortune.com with any questions.

Leaderboard

Fortune 500 Power Moves

Benjamin E. Meisenzahl was promoted to CFO of The Sherwin-Williams Company (No. 191), effective Jan. 1, 2026. Meisenzahl has served as SVP of finance for the last two and a half years. He will assume the CFO duties currently held by Allen J. Mistysyn, who will take on a short-term transition role before retiring after 35 years with the company. Meisenzahl has held multiple roles of increasing responsibility over his 22-year career with Sherwin-Williams, including his current position, as well as global finance and operational roles in the company’s Paint Stores Group, Performance Coatings Group, and Global Supply Chain. He began his career at Sherwin-Williams as an internal auditor.

Every Friday morning, the weekly Fortune 500 Power Moves column tracks Fortune 500 company C-suite shifts—see the most recent edition.

More notable moves

Joe Kauffman was appointed president and CFO of Deel, a global payroll and HR platform. Kauffman joins Deel following more than a decade of leadership at Credit Karma, where he served as CFO, president, and CEO. Before that, he held CFO and corporate development roles at two NYSE-listed companies. Philippe Bouaziz, who has served as Deel’s CFO since the company’s founding, will move into the newly established role of executive chairman and chief strategy officer.

was appointed CFO of

Darktrace, a global AI cybersecurity provider. Raju succeeds Cathy Graham, who joined Darktrace as CFO in 2020 and left the role in September. Raju joins Darktrace with a background in scaling public and private B2B enterprise SaaS companies and leading global finance organizations through periods of transformation. Most recently, he served as CFO at Ivalua. Raju previously held CFO roles at Crownpeak Technologies and SAP Ariba.

Big Deal

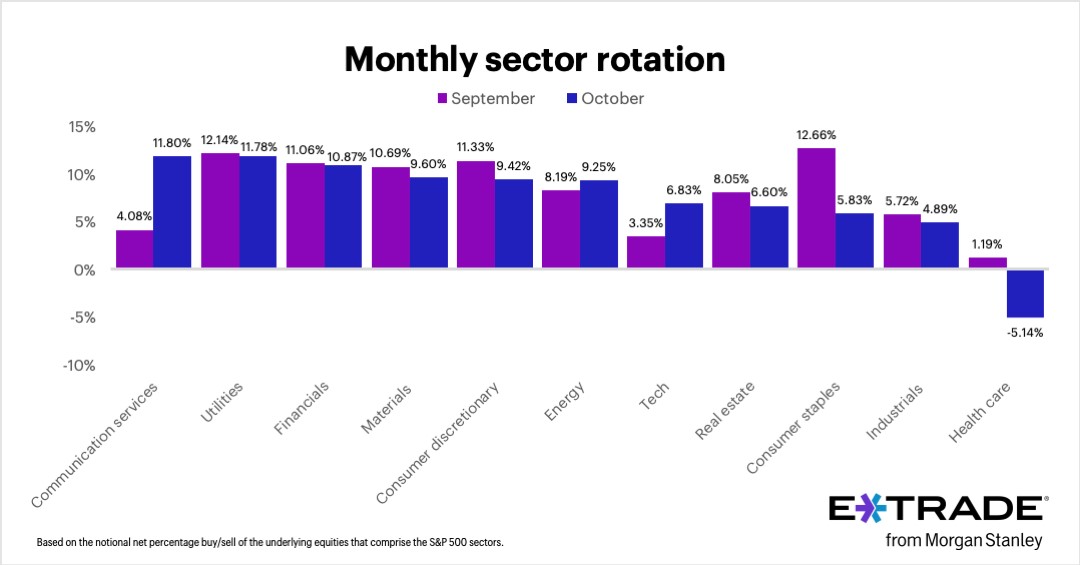

E*TRADE from Morgan Stanley’s monthly analysis found that the firms clients were net buyers in 10 of 11 S&P 500 sectors. The three most-bought sectors in October 2025 were communication services (+11.80%), utilities (+11.78%), and financials (+10.87%). For the second month in a row, activity in utilities appeared to be driven more by risk-on buying in nuclear and alt-energy stocks than by traditionally defensive utility companies, according to Chris Larkin, managing director of trading and investing.

"Tech led the market again in October, and clients continued to target some of the megacap tech names that dominate the communication services sector," Larkin said in a statement. "On the other side of the fence, the shift away from health care may have had an element of profit-taking, with clients appearing to sell some stocks that had rallied strongly in previous months."

Going deeper

"Walmart CEO said paying its star managers upwards of $620,000 yearly empowered them to ‘feel like owners,'" is a Fortune report by Emma Burleigh.

From the report: "For many employees, it can be hard to feel connected to their company, especially at huge corporations like Walmart. But in 2024, Walmart U.S. CEO John Furner pulled out the big guns to ensure star managers feel the love—by paying them upwards of $620,000 per year."

"And that bet has been working so far. In 2024, Walmart claimed the top spot on the Fortune 500—and landed on the Fortune Best Companies to Work For list not just last year, but again in 2025. Walmart said it has also improved its hourly worker retention rate by 10% over the past decade." You can read more here.

Overheard

“These aren’t extraordinary results. These are arguably the best results that any software company has ever delivered.”

—Palantir CEO Alex Karp said on Monday during the company's quarterly earnings call. The defense tech and AI software company posted third-quarter revenue of roughly $1.2 billion, up 63% from the year-ago period and above the average analyst expectation, Fortune reported. Palantir’s government contracts business remains strong; however, business from U.S. commercial customers drove the company’s growth in the third quarter, expanding by 121% year-over-year to $397 million.