In the last few days, I’ve seen the following chart bounce around my corner of the Internet, often with some commentary declaring it the scariest chart in the world. The graph seems to show that the release of ChatGPT and the ensuing AI boom cracked the US economy in two, crushing the workforce while lifting the stock market.

You might have several reactions to this graph, including but not limited to: Should we be alarmed by this picture, irrespective of our emotional reaction to Sam Altman’s face? How is it possible that the stock market is up about 70 percent in the last three years while job openings are down about 30 percent? And, wait, are we even sure the data above are actually true, since, after all, you said you found this thing on the Internet.

Good questions, all. I want to go through them in reverse order, because I think that while this graph is misleading in its presentation, it gestures toward a critical observation: There really do seem to be two economies right now—a booming AI economy and a lackluster everything-else economy—and seeing the drivers behind each is critical to understanding what’s happening and where we’re headed.

To answer the first question: Yes, the numbers are real. The stock market really is on fire, and the labor market really is cooling, and these things really are happening at the same time in a way that’s unprecedented in the modern era.

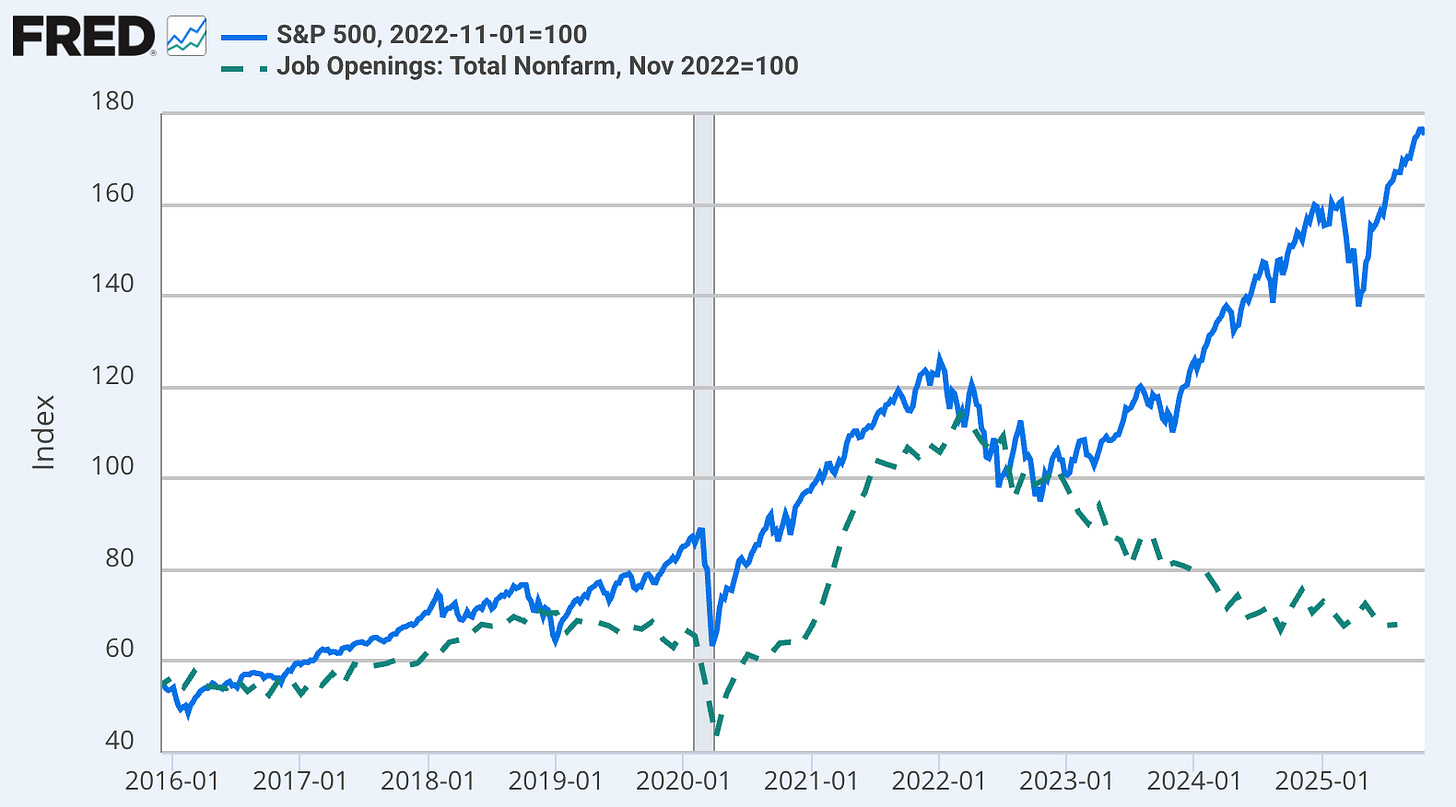

Since October 2022—the month that ChatGPT’s debut supercharged a historic investment boom in AI—total job postings in the economy have, in fact, declined by about one third, while the S&P 500 has increased by 75 percent. Both things are true, and their juxtaposition is fairly historic.1 For the last few decades, job openings have mostly tracked the rise and fall of the stock market. Nothing like the current divergence between equity returns and job openings has ever occurred in the history of the Job Openings and Labor Turnover Survey (JOLTS), which was first released in 2002.

Now that I’ve told you that this graph isn’t completely made up, it might be reasonable for some folks to worry that this is indeed the first chapter of a long saga that will eventually go by the name of “How Artificial Intelligence Ate the American Economy and Destroyed the Working Class.” But:

Just because two things are happening at the same time doesn’t mean one is causing the other. And when we look closely, there are more prosaic forces that are depressing hiring.

It’s possible that the generative AI boom created a new economic paradigm, which I’ll return to at the end of this essay. For some big tech companies, perhaps the high cost of frontier chips, data centers, and energy is making it prohibitively expensive to hire and retain more workers while maintaining the desired profit margin, and so big tech companies are shoveling their free cash flow into data centers rather than into new headcount. (Consider Meta: its headcount has fallen while its stock has soared.)

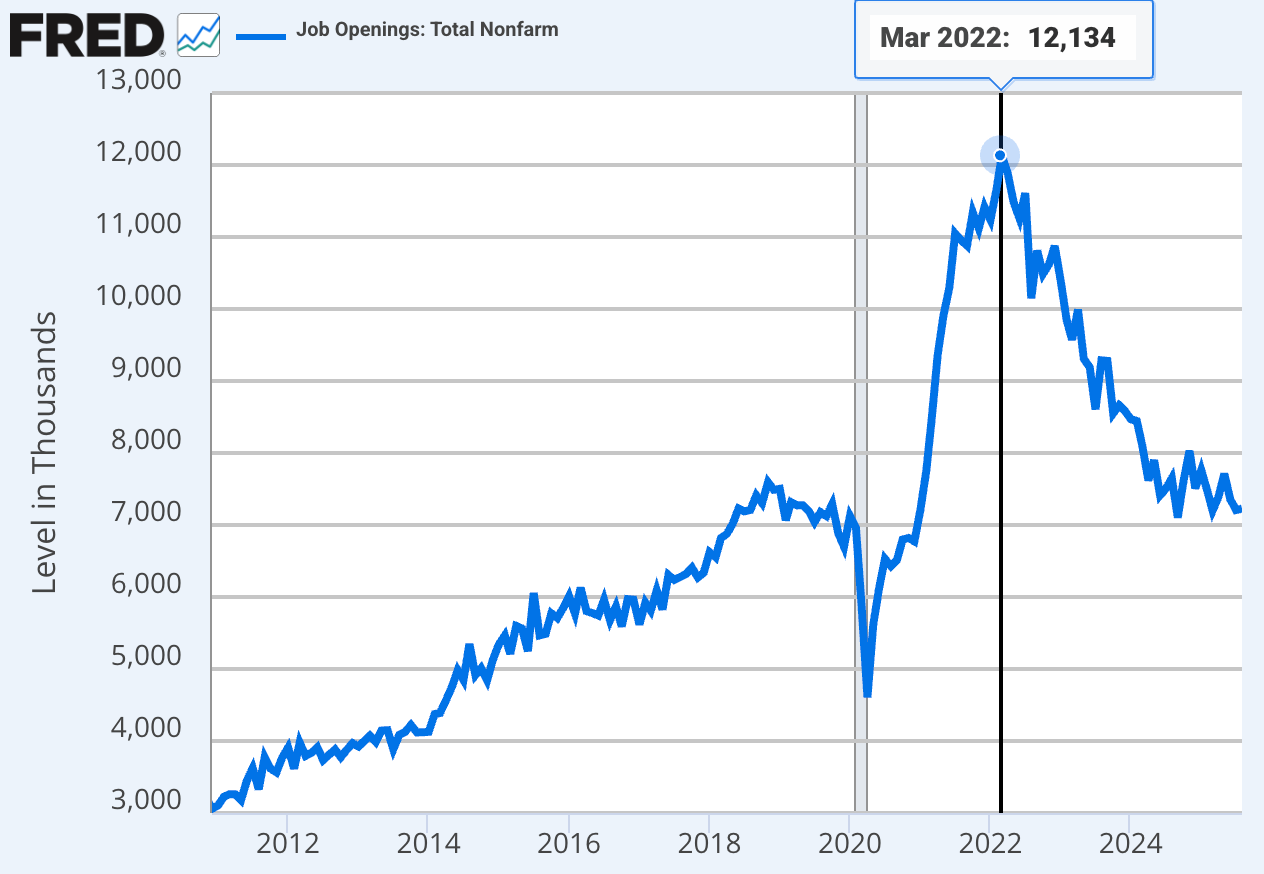

But there’s at least one big problem with the idea that generative AI is responsible for the overall decline in job openings. Job listings did not peak in November 2022, when ChatGPT came out. They peaked in March 2022, the same month the Federal Reserve raised interest rates for the first time this cycle.

The goal of the Fed’s interest rate hikes was to reduce inflation by destroying demand. Higher rates are meant to lead to less investment, less spending, and less economic activity, which altogether can have the effect of reducing hiring. That’s exactly what’s happened. In this telling, ChatGPT didn’t wallop the labor market; the Fed did2. Meanwhile, the Trump administration’s tariff and immigration policies have raised input costs and reduced labor force growth, which have further squeezed hiring.

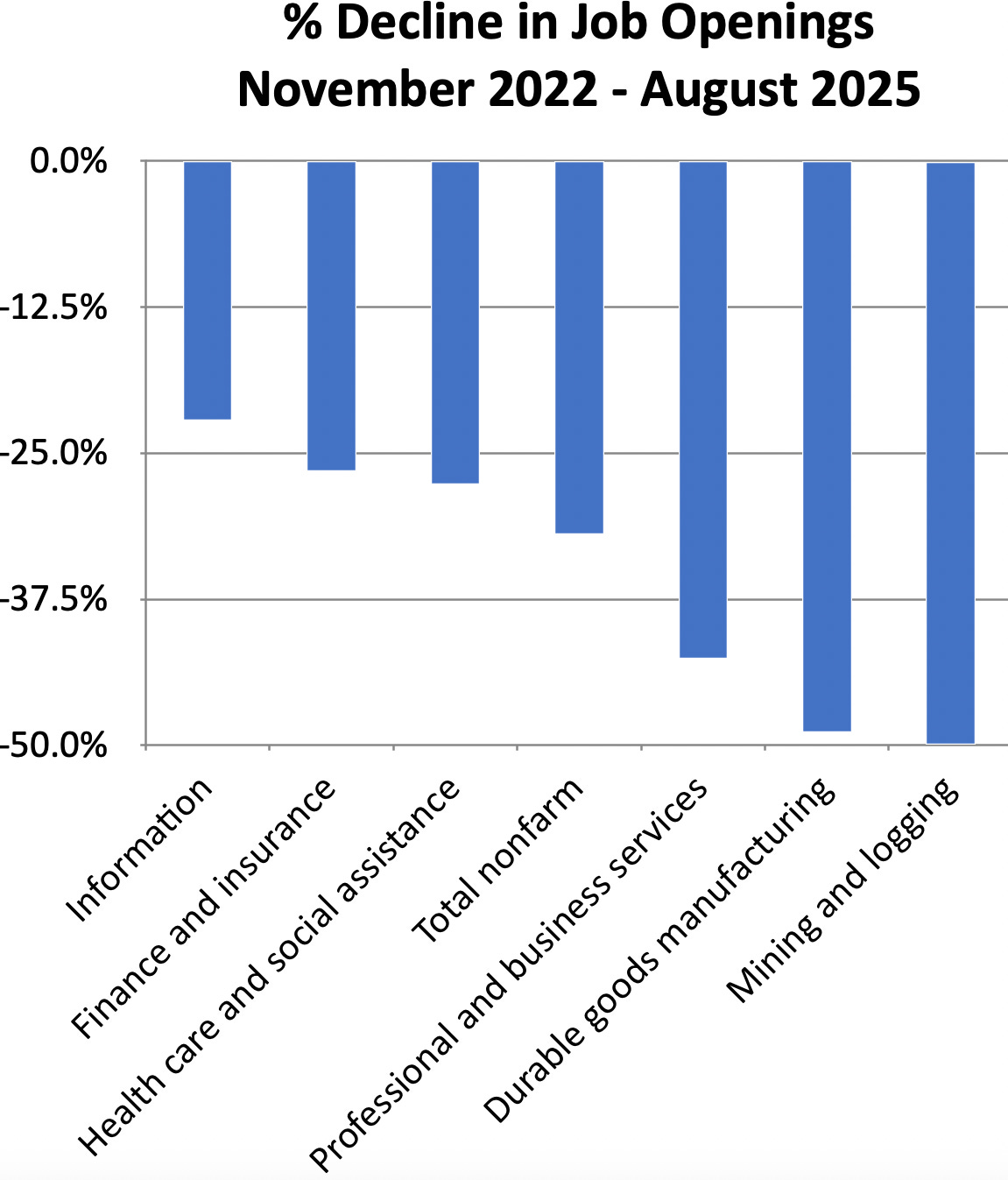

If the real threat to employment right now were coming from AI, you would expect that the parts of the economy closest to AI would be suffering the most. That gives us a testable prediction: If AI is crushing the labor market, the “Information” sector should see the steepest drop in job postings. To know if that’s happening, I reached out to Preston Mui, a senior economist at Employ America, to provide a tidy breakdown of the decline in job openings by sector since the release of ChatGPT. Here’s what he found:

The first thing I notice in this picture: The “Information” super-sector—which includes software programmers and most people who work directly on tech—has the smallest decline in job openings. That is absolutely NOT what you would expect to see in a world where AI was the dominant force reducing hiring. The second thing I notice: The largest declines in job openings come from manufacturing, construction, and energy extraction, three sectors that are all deeply affected by tariffs and that rely on investment that’s become more expensive with higher interest rates.3

So, big picture: The decline in job openings is almost certainly about monetary, trade, and immigration more than it’s about AI. Now that leaves another mystery: If the labor market is catching a cold, why is the S&P 500 living its best life?

The stock market boom is both stranger and more normal than it appears.

AI-related stocks have accounted for 75 percent of S&P 500 returns and 80 percent of earnings growth since ChatGPT launched in November 2022, according to JP Morgan. That is a completely insane statistic that might suggest that we’re in the middle of an unsustainable bubble. But in the last few months that I’ve been reporting on the AI boom, I’ve become frustrated with a big glaring hole at the center of the analysis: