Consensus is a precious commodity these days, so it’s striking that every financial newspaper, podcast, newsletter, cable news segment, and hyper-edited TikTok video has erupted in spontaneous agreement that artificial intelligence is history’s most obvious bubble. Even the industry titans are all singing the melody line:

Jeff Bezos called AI “an industrial bubble.”

Bret Taylor, chairman of the board of OpenAI, said, “I think we’re also in a bubble.”

David Solomon, CEO of Goldman Sachs, told a recent conference that “there will be a check at some point, there will be a drawdown.”

Jamie Dimon, head of JPMorgan Chase, said he was “far more worried” than others about a big correction … which is a funny thing to say, because nobody will shut up about how exquisitely aware they are that AI is a bubble.

And yet, look around: Is anybody actually acting as if AI is a bubble? Ordinary investors, who are theoretically consuming all this stuff, are still donating their life savings to the silicon gods. (By one estimate, AI companies have accounted for more than 70 percent of US stock gains in 2025.) Bezos’s successor, Andy Jassy, has said Amazon will spend over $100 billion on AI infrastructure this year. OpenAI’s plans reportedly imply trillions of dollars in capital spending across the decade.

A bubble is supposed to be reality’s way of interrupting fantasy1. Today, however, fantasy and reality are waltzing together in a strange romance. Everyone claims that they know the music is ending soon, and yet everybody is still dancing along to the music. The whole thing is vaguely Augustinian: O Lord, make me sell my Nvidia position and rebalance toward consumer staples, but not yet.

So for the last few weeks, I’ve been troubled by a stubborn anxiety: If everyone “knows” that everyone else knows that AI is a bubble, is that maybe a sign that … everyone is wrong?

The Bubble Case: A Reminder

Two weeks ago, I published my conversation with the investor and writer Paul Kedrosky on the bubble case for artificial intelligence. Within a few days, it was one of the most-read and most-cited articles I’ve published on this blog/newsletter. The whole conversation is wide-ranging and interesting, but if I had to boil it down to five points, these are the most important warning signs about an imminent bubble pop:

Lofty valuations for companies with no clear path to profit

I can’t stop thinking about the story of Thinking Machines, the AI startup founded by former OpenAI executive Mira Murati. It raised $2 billion at a $10 billion valuation, which is the largest seed round in history. The company has no product. It won’t even tell most investors what it’s trying to build, or why that thing will be different from the zillions of other companies trying to build thinking machines (lowercase). This is just one story we know about. There are many companies taking on billions of dollars in collective VC capital by creating teams of smart people organized around the vague principle that they’re going to build a super-intelligent machine. This singular and emphatic emphasis on AI in the startup world seems to contradict an industry that’s supposedly all about finding secrets and zigging where others zag.

Unprecedented spending on an unproven business

Trillions of dollars will be spent this decade to build AI infrastructure—something the private sector has never done before without government partnership. The Apollo program allocated about $300 billion in inflation-adjusted dollars to get America to the moon between the early 1960s and the early 1970s. The AI buildout requires companies to collectively fund a new Apollo program, not every 10 years, but every 10 months. And things might get crazier. In September, Oracle’s stock popped after it announced a future deal with OpenAI worth hundreds of billions of dollars. The catch: Oracle won’t be able to finance the deal with its cash flow. It’ll have to take on a sensational amount of debt. JP Morgan’s incomparable Michael Cembalest described the deal this way:

Oracle’s stock jumped by 25% after being promised $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants)

A historic chasm between capex spending and revenue

The investor and writer Azeem Azhar has estimated that annual AI-related data-center spending in 2025 is around $400 billion, while AI revenue this year will total about $60 billion. That’s a 6x-7x gap. By comparison, the capex-revenue ratio for telecom companies during the dot-com fiber-optic bubble was about 4x; for the railroad companies building the transcontinentals in the 1870s, it was 2x. It is never a good sign to find an statistic that says today’s tech boom is three times more “bubbly” than the 1870s railroad build-out (which crashed and burned constantly) and 50 percent frothier than the dot-com bust.

An eerie level of financial opacity

The hyperscalers—big tech companies, such as Microsoft and Meta, that are spending the most on AI infrastructure—are doing some awfully funny stuff with their budget accounting. When these tech firms report their capital expenditures in earnings statements, they typically spread the cost of infrastructure, like AI chips and data centers, over five years. But most analysts think they’ll need to replace their cutting-edge chips every two or three years. In the short run, this depreciation schedule might make the big tech firms’ balance sheets look healthier than they really are in the short-run and worse and worse in the long run. What’s more, many of these companies are building special-purpose vehicles to move the true cost of their data-center expansion off their balance sheets. (If you’re confused and want to know more about this, Paul does a great job of explaining it here.)

A byzantine level of corporate entanglement

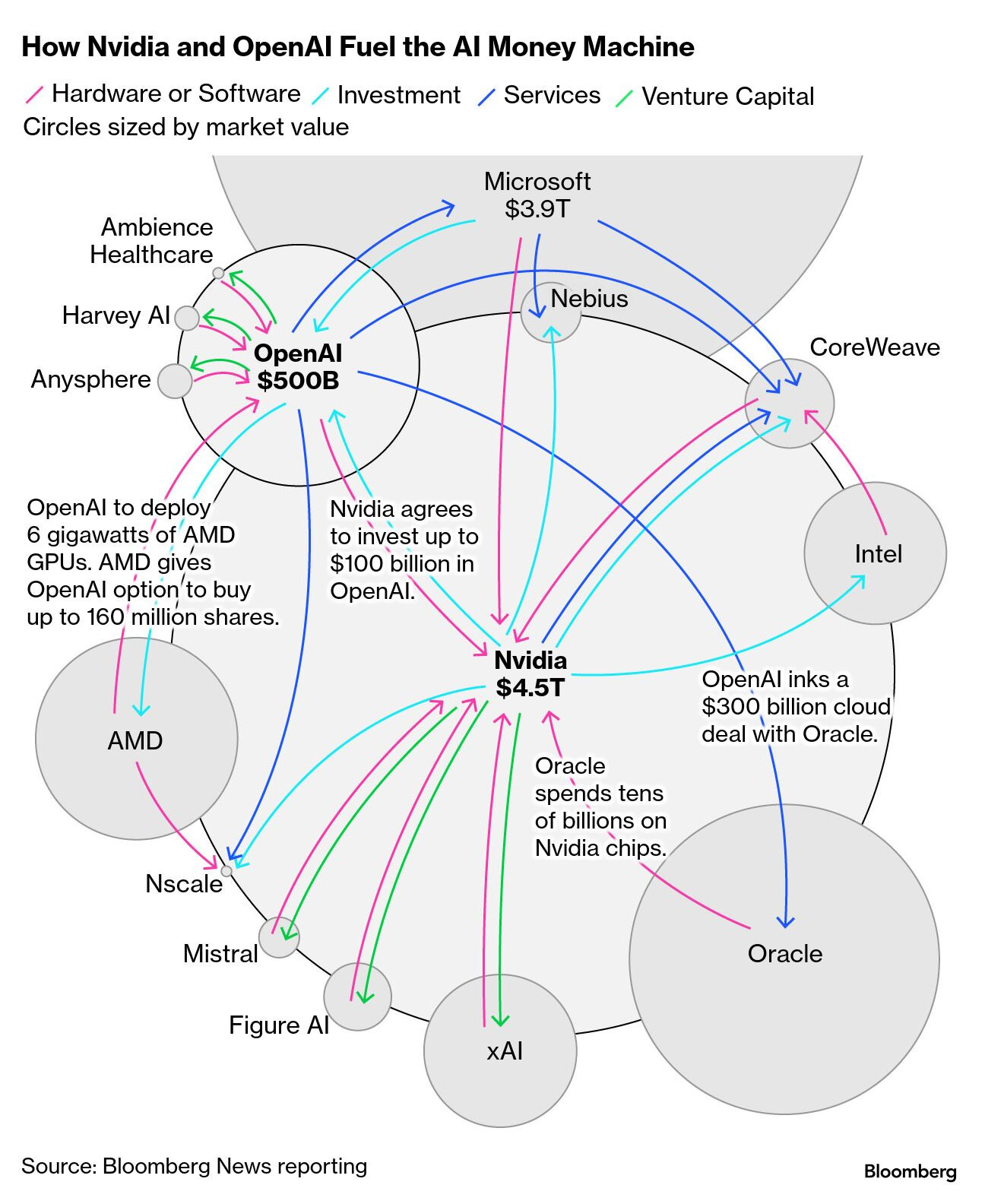

The AI companies are all in bed with one another in a way that I do not explicitly intend as a description of San Francisco nightlife. Anthropic uses Amazon’s web services to power its models, and Amazon is also an investor in Anthropic. Microsoft invested in OpenAI and books cloud revenue from OpenAI. Nvidia and Advanced Micro Devices buy equity in companies to which they sell chips. Bloomberg made this illegible situation moderately more legible with this infographic of AI’s unusual degree of corporate polyamory:

As Azhar writes, this “financial ouroboros” is all rather reminiscent of the telecoms during the dot-com go-go years:

Lucent and Nortel extended billions in loans to nascent network operators, who used that borrowed capital to buy switching kit and fiber optic cables—well before they had paying customers to justify the build-out. Cheekily, the vendors immediately booked those sales as revenue. The startups reported explosive growth; the equipment suppliers hit quarterly targets; Wall Street applauded. In fact, all they had done was moving money from the financing sleeve to their revenue sleeve while taking on enormous credit risk. As the fiber lay unlit, defaults filled the gap and phantom revenue disappeared. The snake swallowed itself.

When you put all this together, you can understand why “AI is a bubble” has become a wisdom so conventional that even OpenAI’s chairman is saying it out loud. And yet, for all that froth, there’s a strong case that this is not the dot-com era redux.