When a company’s share price suddenly jumps, it’s usually in response to announcements—like a merger or a great earnings release—that top executives have prepared for weeks. Sometimes, though, the good news comes out of the blue and is as much of a surprise to the CEO as it is to the rest of market. That’s what happened last month, when S&P Dow Jones announced that the financial platform Robinhood would be joining its all-important index of 500 leading U.S. companies, leading the price of HOOD shares to soar nearly 16% in a day.

The company’s CEO, Vlad Tenev, was quick to issue a statement (“It’s an exciting milestone to have Robinhood join the storied S&P 500 Index”). But the company confirmed that Tenev found out about the news like everyone else—from an S&P press release that, on days when one goes out, always lands at 5:15 p.m. ET, but whose content is otherwise unpredictable.

The pop in Robinhood’s stock was akin to what happened to that of the 10 other companies—including DoorDash, Coinbase, and analytics service AppLovin—that have joined the S&P 500 so far this year as part of what the index-maker calls its effort to “rebalance” the list.

The reason for the price jumps is easy to discern. It’s not simply the prestige of being placed on a list of 500 iconic companies. Instead, it is because a large number of ETFs and institutional investors automatically add new entrants to their portfolios shortly after the chosen companies are announced, scooping up millions and millions of shares in the process. The more interesting question is instead how S&P Dow Jones compiles the list in the first place.

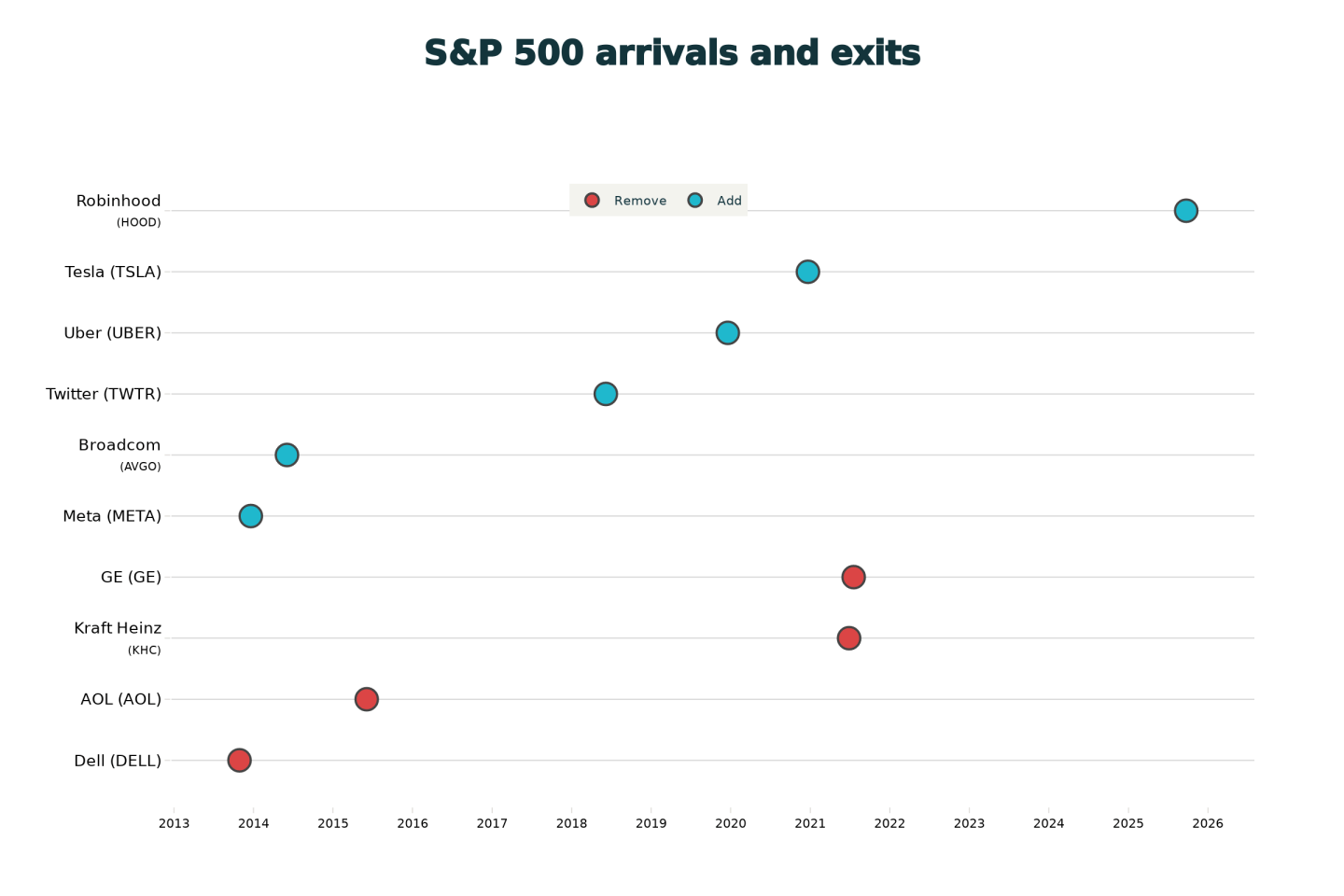

If anyone is in position to answer questions about the process, it is Howard Silverblatt. The senior index analyst has worked at S&P Dow Jones for 49 years, and has seen successive waves of companies and sectors arrive and exit from the list. That has included a growing number of tech and IT firms taking their place, pushing off the likes of print publishers and old-line industrial companies in the process. This graphic, made using Perplexity and based on public data, shows some of the notable changes to the list over the past decade:

Perplexity

When firms fall off the S&P 500, it is often because of a merger or breakup. But as was the case with casino firm Caesars Entertainment, which was removed to make way for Robinhood, in the absence of those kinds of events these disappearances are at the discretion of the 10-member committee overseeing the index.

So who exactly sits on that committee? That’s a closely held secret. According to Silverblatt, who won’t say if he was among those who presided over the latest shuffle, S&P Dow Jones doesn’t reveal the names of committee members in order to shield them from lobbying. This system, which also forbids committee members from having a personal stake in any of the companies at issue, appears to be working, as there appear to be no obvious instances of a company buying its way onto the list.

That doesn’t mean getting added to the list is simply a matter of chance. To qualify in the first place, a public company must post four straight quarters of profitable earnings results, and be a large-cap stock with a market cap of at least $22.7 billion, and with a large number of highly-traded shares. And, once on the list, companies are subject to quarterly re-weighting to reflect their relative significance. For practical purposes, this means that Robinhood and Nvidia will not each represent 1/500 of the S&P 500—instead the latter counts for around 8% of the overall index, while Robinhood will count for a relatively tiny amount.

Silverblatt says the broader criteria for assembling the S&P 500 is to create an up-to-date snapshot of the entire U.S. economy at a given time, meaning the list is more dynamic than the 30 companies on the industrial-focused Dow Jones index, or the Fortune 500, which ranks the world’s biggest businesses by revenue.

When it comes to the committee choosing companies, he says the body has more heterogeneous backgrounds than when he joined in 1977, when it consisted of a “group of guys from the same business school drinking Scotch.”

Today, Silverblatt says, “In assembling a portfolio, we need different types of people. It can’t be just quants or just fundamentalists.”

returns Oct. 26–27, 2025 in Riyadh. CEOs and global leaders will gather for a dynamic, invitation-only event shaping the future of business.

Apply for an invitation.