临近三季度末,监管部门对券商的合规审查力度不减。9月30日,安徽、大连、浙江、深圳、广东等地的证监局共开出11张罚单,涉及国融证券、恒泰长财证券、中金财富、英大证券、广发证券等5家券商。罚单涵盖经纪业务、研究业务、投行业务等多个领域,其中英大证券及其分支机构、人员共收到5张罚单。此次处罚聚焦从业人员不当言论、代客理财以及债券托管等业务的核查,显示出监管部门持续加强券商合规管理的决心,严监管、严问责的态势预计将贯穿全年。

Regulatory Pressure Intensifies: As the third quarter drew to a close, multiple local branches of the China Securities Regulatory Commission (CSRC) in Anhui, Dalian, Zhejiang, Shenzhen, and Guangdong jointly issued 11 penalty notices. These fines were directed at five securities firms: Guorong Securities, Hengtai Changcai Securities, CICC Wealth, Yingda Securities, and GF Securities. This concentrated regulatory action underscores a sustained high-pressure environment for compliance within the securities industry.

Broad Scope of Violations: The penalties cover a wide range of business areas, including brokerage, research, and investment banking services. Specifically, Yingda Securities and its related entities and personnel were subject to five separate fines, indicating a significant compliance issue within that firm. The violations highlight the comprehensive nature of regulatory oversight, examining multiple facets of a securities firm's operations.

Focus on Key Compliance Risks: The regulatory actions specifically target persistent compliance issues such as inappropriate remarks by employees on self-media platforms, discretionary asset management (代客理财), and thorough testing of operations like bond custody. This focus suggests that regulators are prioritizing the prevention of misconduct and the strengthening of internal controls in areas that have historically presented significant risks.

Yingda Securities Faces Most Penalties: Yingda Securities was the most heavily penalized firm, receiving five separate fines. These penalties were distributed across its branches, individual employees, former branch managers, and senior management responsible for brokerage business. This indicates a systemic compliance failure within Yingda Securities, with accountability extended to various levels of the organization, including a senior executive overseeing brokerage operations.

Specific Violations Detailed: Examples of specific violations include CICC Wealth's Port Xing Road Securities Business Department being suspended from handling professional investor recognition for three months due to management shortcomings. Yingda Securities' Dongguan Dongcheng Securities Business Department faced issues with insufficient monitoring of employee investment activities, inadequate compliance training for brokers, and poor management of employee social media accounts. An analyst from GF Securities was disciplined for spreading unverified information in a WeChat group. Hengtai Changcai Securities was penalized for failing to diligently supervise the use of funds in bond offerings, where over 60% of the raised capital was misappropriated by the controlling shareholder. Guorong Securities was found to have inadequate due diligence in the underwriting and custody of corporate bonds.

Sustained Strict Regulation Expected: The article emphasizes that the current trend of strict regulation and accountability is not a temporary measure but a sustained approach. The issuance of these penalties on the last day of the quarter serves as a strong signal that the robust oversight and stringent enforcement of rules for securities firms will continue. This suggests that firms must prioritize and invest in robust compliance frameworks to navigate the evolving regulatory landscape.

财联社9月30日讯(记者 高艳云)三季度收官日再现监管高压态势。

9月30日,安徽、大连、浙江、深圳、广东等5地证监局披露共计11张罚单,涉及5家券商,包括国融证券、恒泰长财证券、中金财富、英大证券、广发证券,覆盖经纪业务、研究业务、投行业务等多个领域。其中,英大证券及其分支机构、人员独揽5张罚单。

具体违规罚单如下:

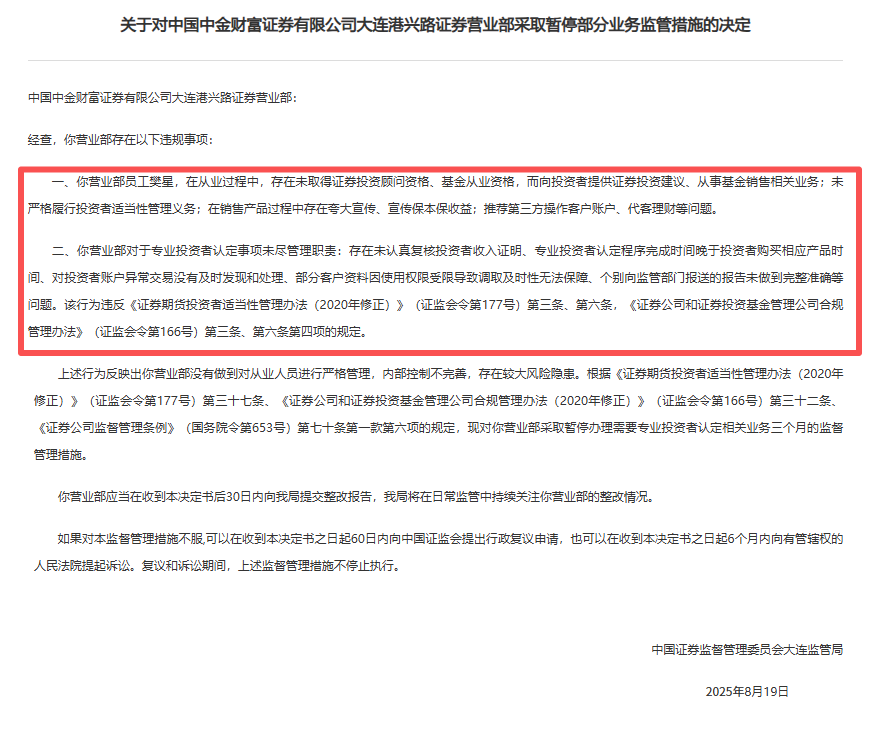

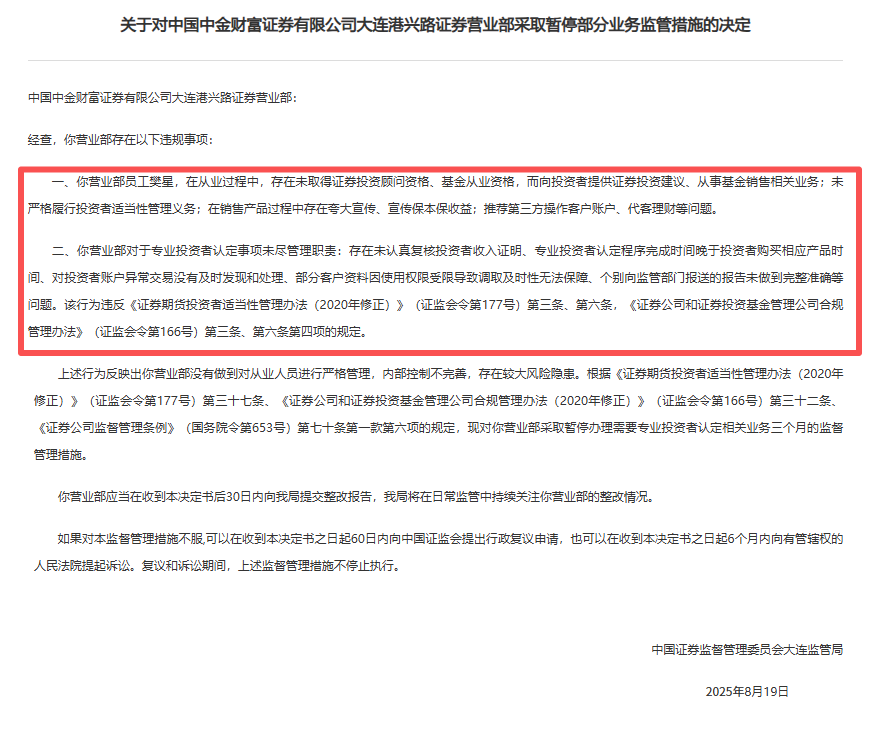

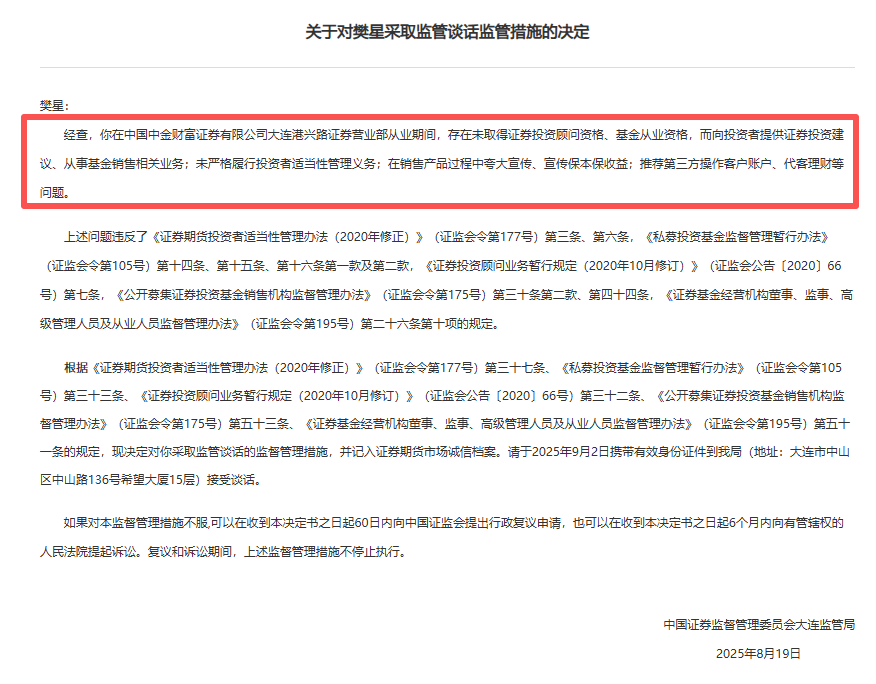

中金财富:大连港兴路证券营业部被采取暂停办理需要专业投资者认定相关业务三个月的监督管理措施,营业部员工樊星被采取监管谈话监管措施。

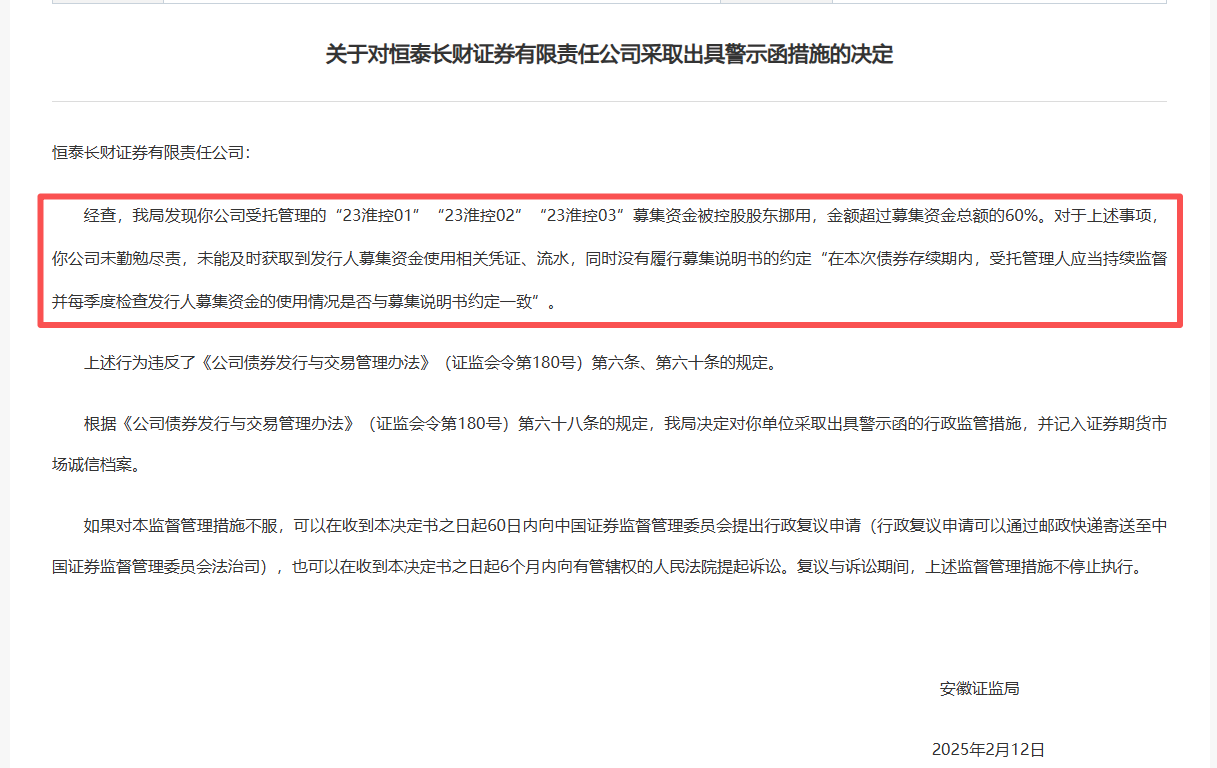

恒泰长财:公司被采取出具警示函措施。

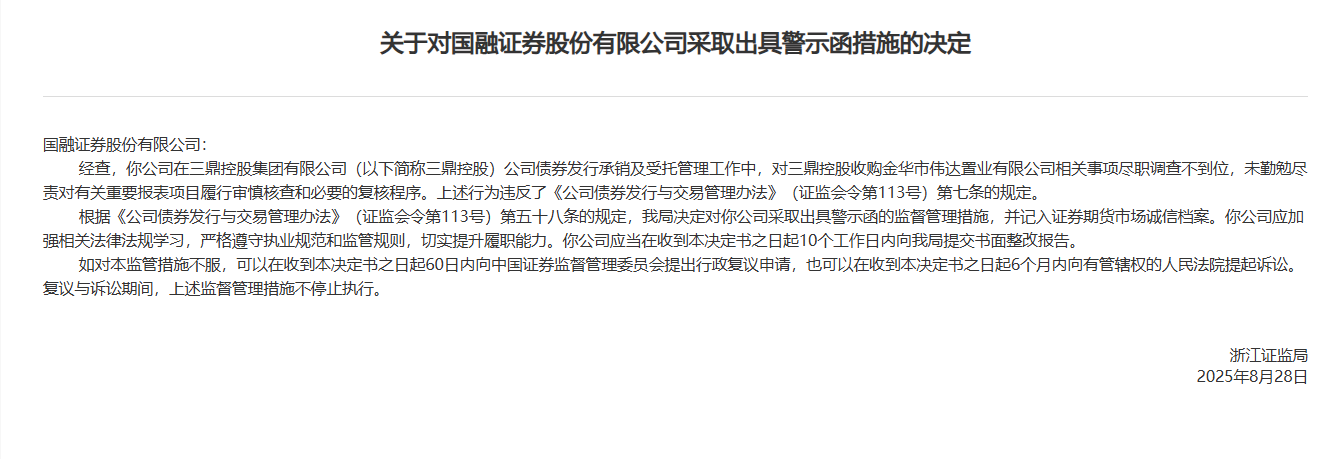

国融证券:公司被采取出具警示函措施。

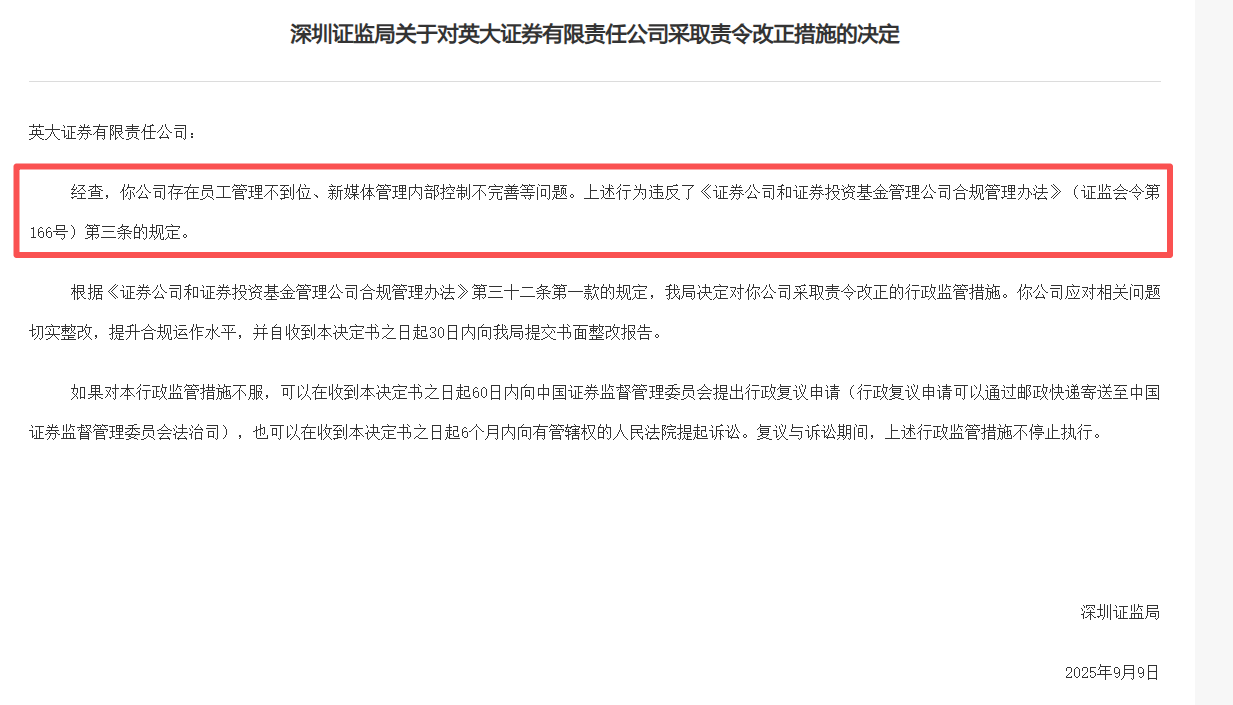

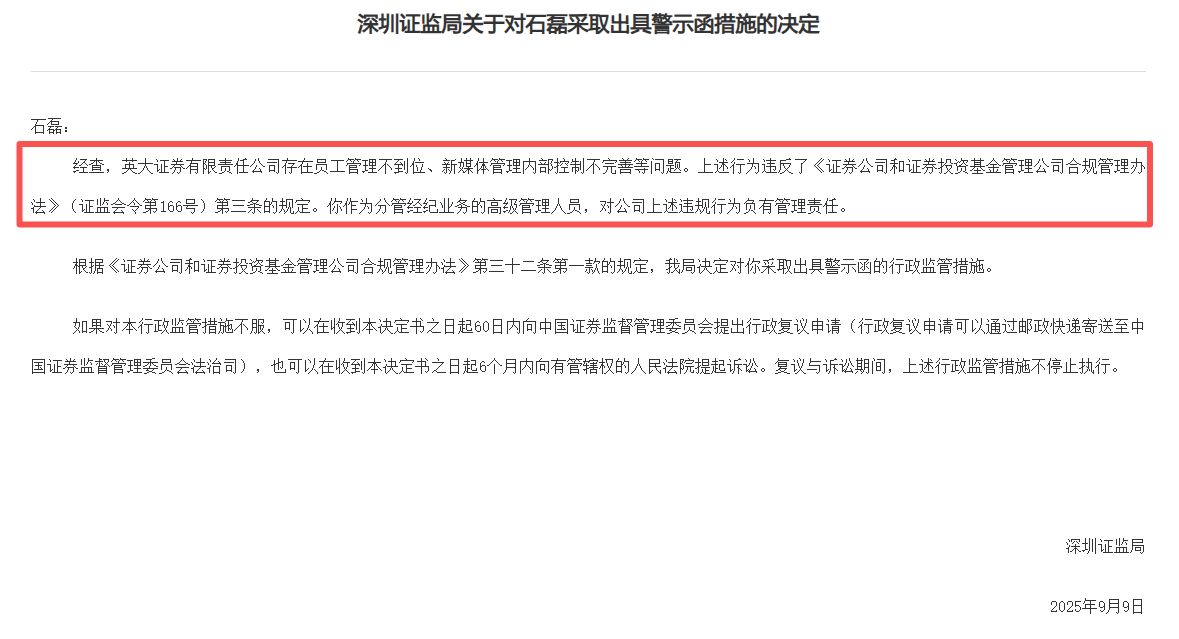

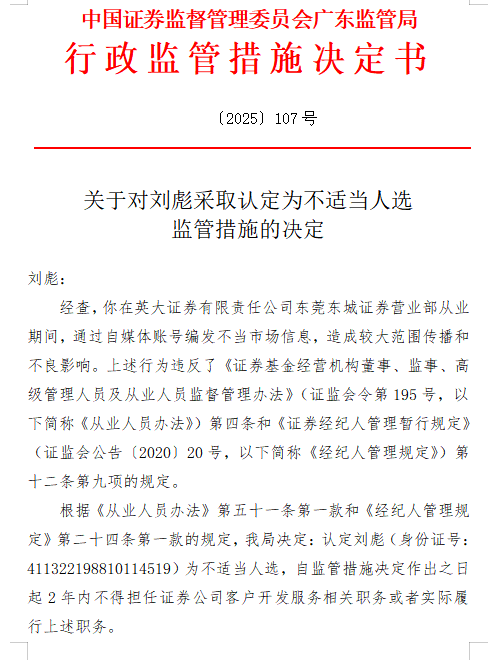

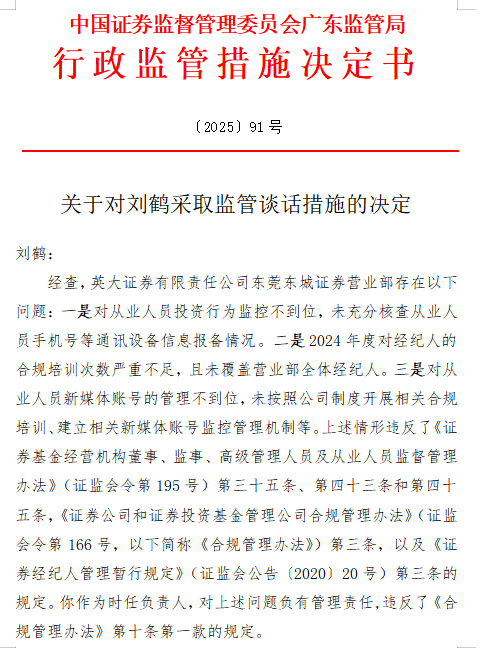

英大证券:公司被采取责令改正措施,东莞东城证券营业部被采取责令改正措施,从业人员刘彪被采取认定为不适当人选监管措施,营业部时任负责人刘鹤被采取监管谈话措施,公司分管经纪业务高管石磊采取出具警示函措施。

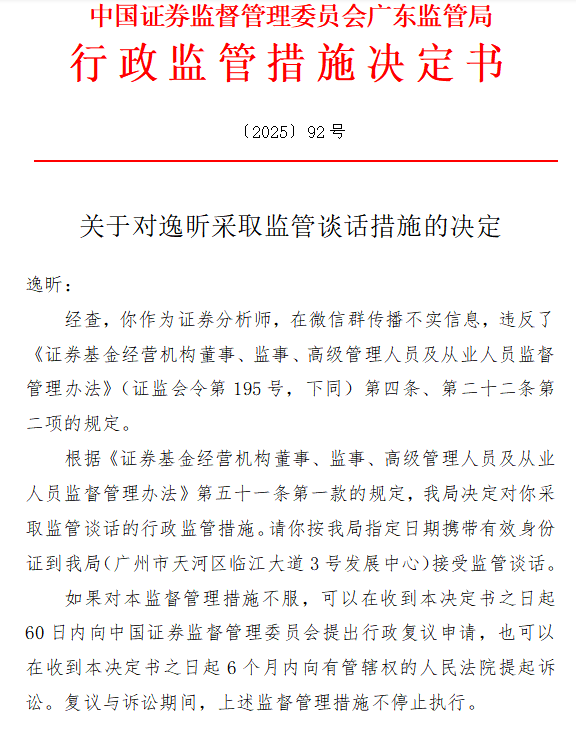

广发证券:公司被采取责令改正措施,证券分析师逸昕被采取监管谈话措施。

券商合规监管已触达“神经末梢”,重点盯防从业人员自媒体不当言论、代客理财等顽疾,及债券托管等业务“穿行测试”式核查,为各地证监常态化重点。今日罚单印证此思路,强监管严问责基调将延续全年。

英大证券:连收5张罚单,分管副总同被罚

英大证券是今日罚单最多券商,多达5张,涉及营业部、从业人员、时任营业部负责人、分管经纪业务高级管理人员以及公司总部。

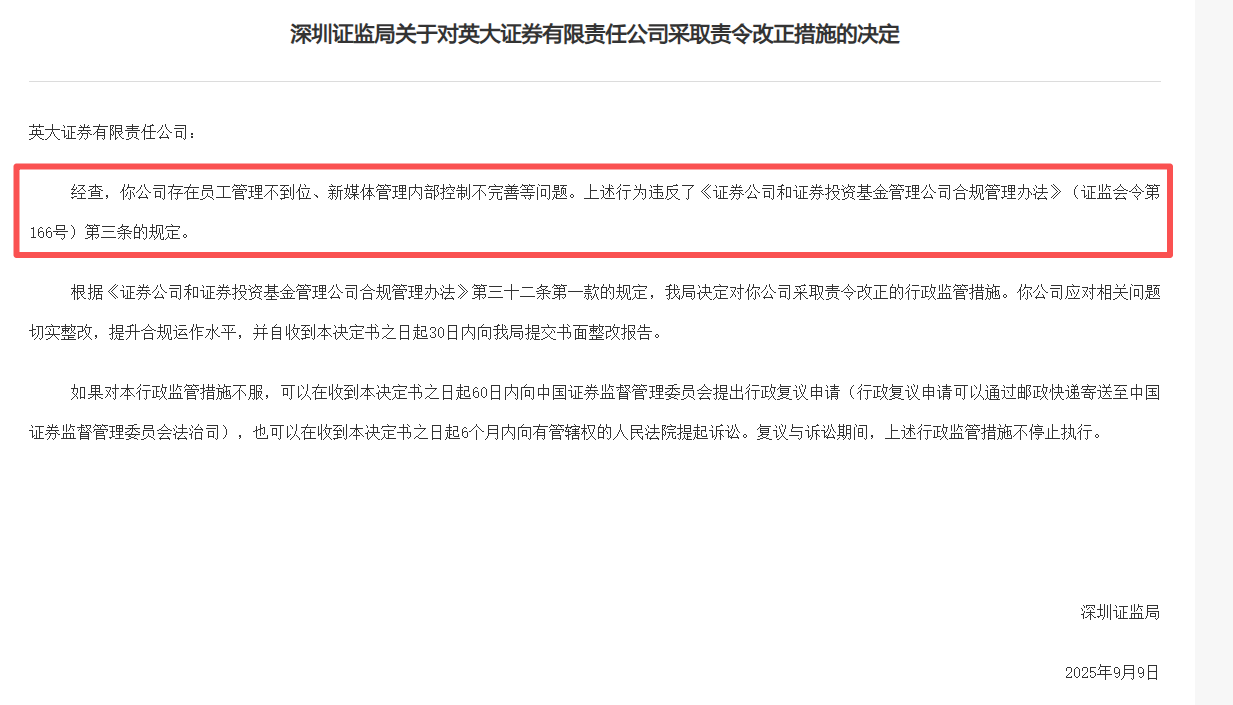

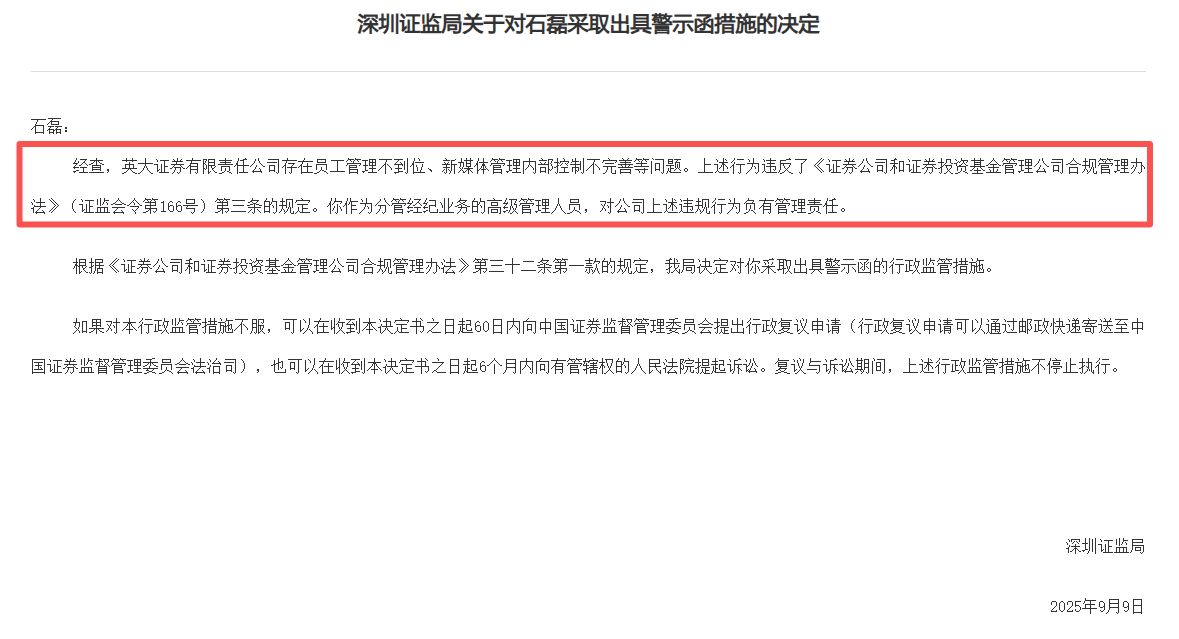

深圳证监局披露罚单指出,英大证券存在员工管理不到位、新媒体管理内部控制不完善等问题。作为分管经纪业务的高级管理人员,石磊对公司上述违规行为负有管理责任。

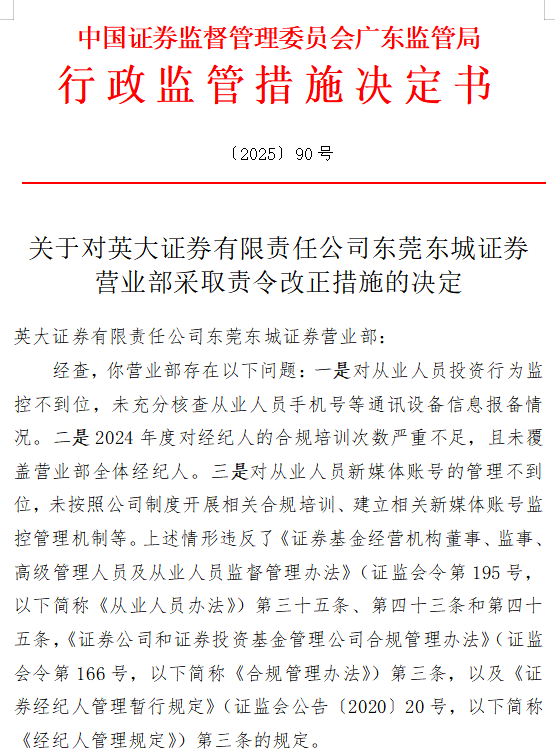

广东证监局罚单显示,英大证券东莞东城证券营业部业部存在以下问题:

一是对从业人员投资行为监控不到位,未充分核查从业人员手机号等通讯设备信息报备情况;

二是2024年度对经纪人的合规培训次数严重不足,且未覆盖营业部全体经纪人;

三是对从业人员新媒体账号的管理不到位,未按照公司制度开展相关合规培训、建立相关新媒体账号监控管理机制等。

刘彪在英大证券东莞东城证券营业部从业期间,通过自媒体账号编发不当市场信息,造成较大范围传播和不良影响。广东证监局认定刘彪为不适当人选,自监管措施决定作出之日起2年内不得担任证券公司客户开发服务相关职务或者实际履行上述职务。

作为营业部时任负责人,刘鹤对上述问题负有管理责任。

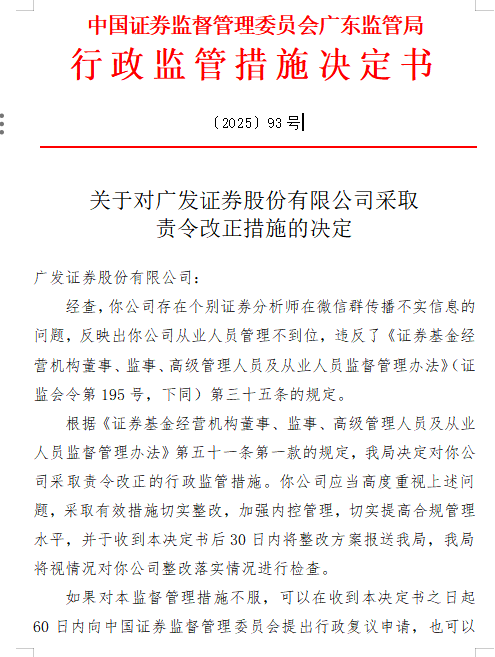

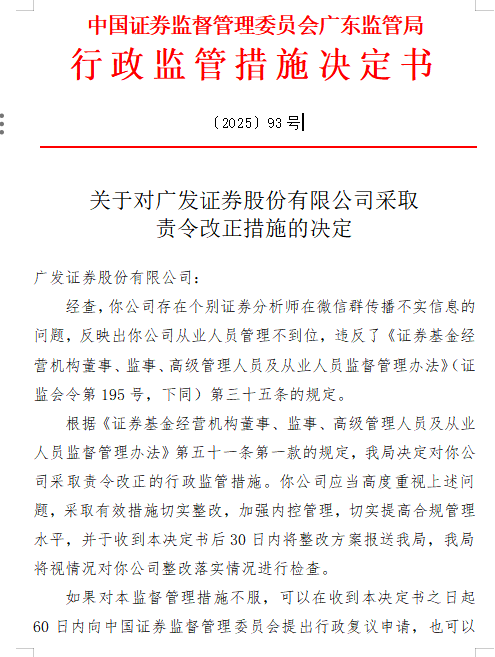

广发证券:分析师在微信群传播不实信息

广东证监局披露罚单显示,广发证券存在个别证券分析师在微信群传播不实信息的问题,反映出公司从业人员管理不到位。

作为证券分析师,逸昕在微信群传播不实信息。

中证协从业人员公示信息显示,逸昕最早于2017年1月14日执业,执业机构包括华源证券、天风证券以及当前的广发证券,登记类别先后包括证券经纪人、一般证券业务证券投资咨询(分析师)。逸昕与2024年3月20日在广发证券执业,目前登记状态为“正常”。

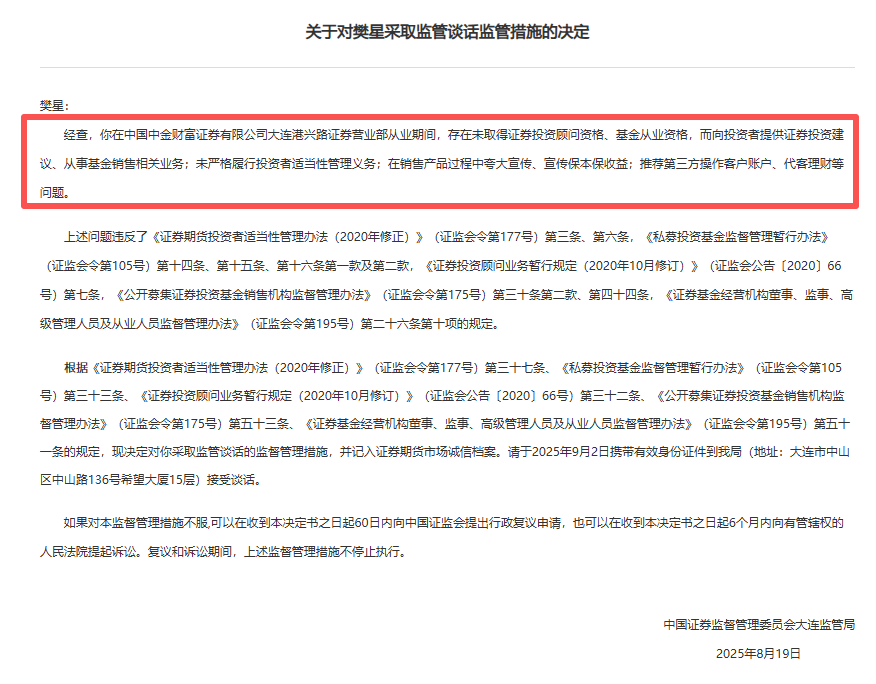

中金财富:营业部曝合规问题

中金财富大连港兴路证券营业部员工樊星,在从业过程中,存在未取得证券投资顾问资格、基金从业资格,而向投资者提供证券投资建议、从事基金销售相关业务;未严格履行投资者适当性管理义务;在销售产品过程中存在夸大宣传、宣传保本保收益;推荐第三方操作客户账户、代客理财等问题。

上述营业部对于专业投资者认定事项未尽管理职责,存在未认真复核投资者收入证明、专业投资者认定程序完成时间晚于投资者购买相应产品时间、对投资者账户异常交易没有及时发现和处理、部分客户资料因使用权限受限导致调取及时性无法保障、个别向监管部门报送的报告未做到完整准确等问题。

大连证监局指出,上述行为反映出营业部没有做到对从业人员进行严格管理,内部控制不完善,存在较大风险隐患。

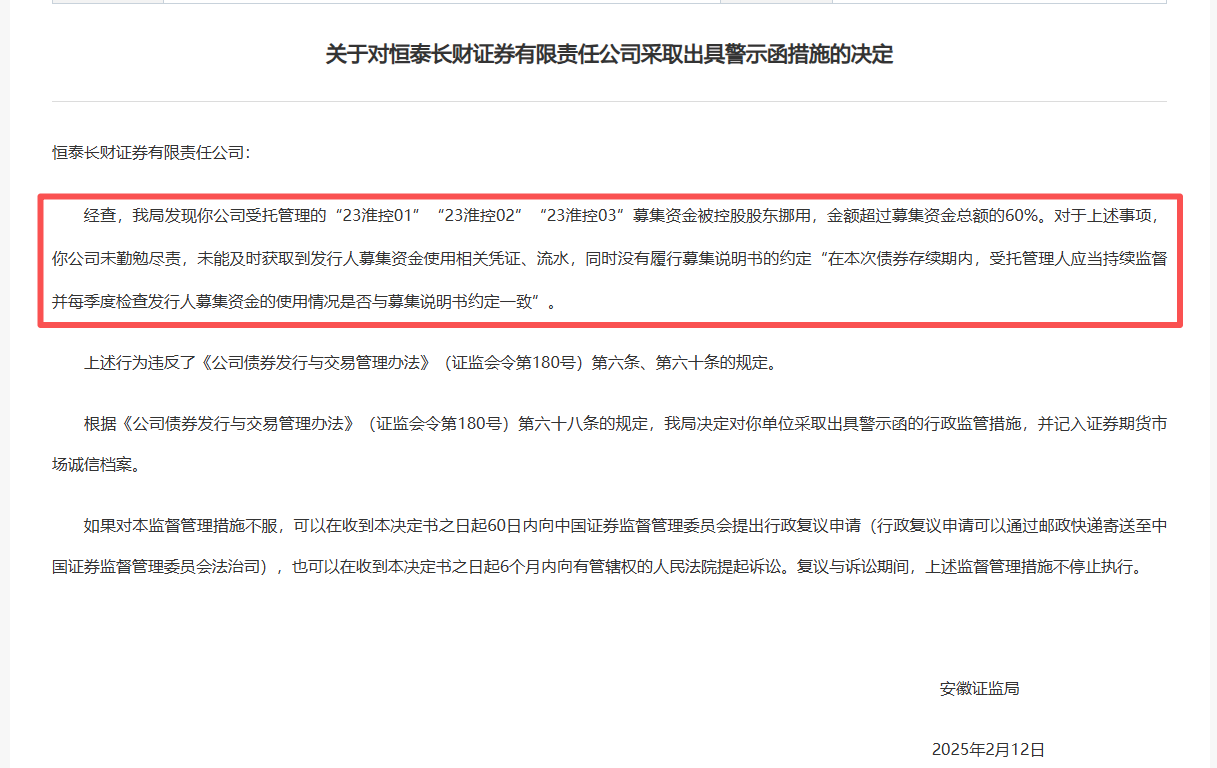

恒泰长财:债券托管未勤勉尽责

罚单显示,恒泰长财证券受托管理的“23淮控01”“23淮控02”“23淮控03”募集资金被控股股东挪用,金额超过募集资金总额的60%。

安徽证监局指出,对于上述事项,恒泰长财证券未勤勉尽责,未能及时获取到发行人募集资金使用相关凭证、流水,同时没有履行募集说明书的约定“在本次债券存续期内,受托管理人应当持续监督并每季度检查发行人募集资金的使用情况是否与募集说明书约定一致”。

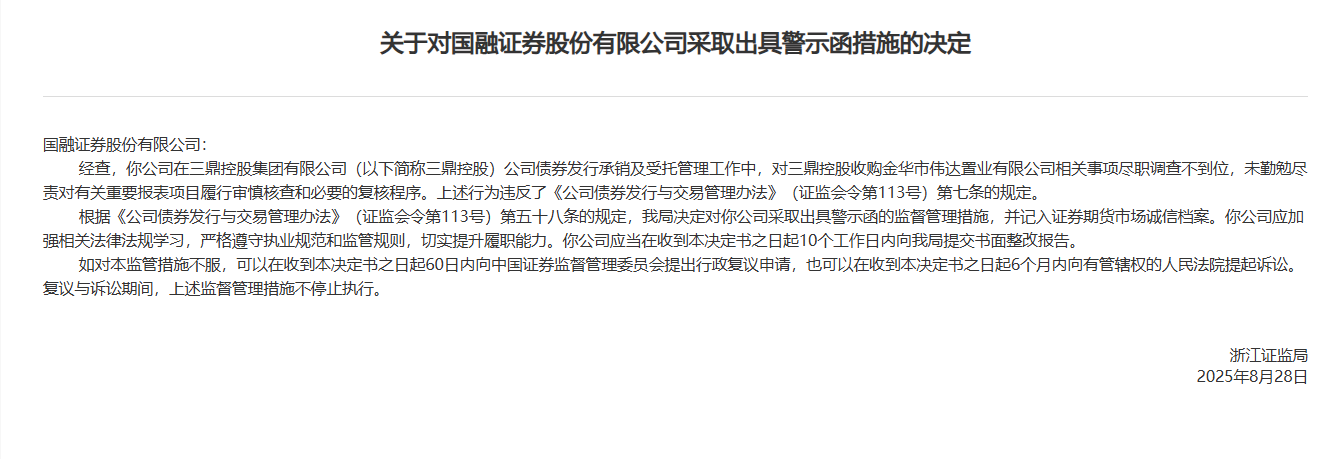

国融证券:公司债承销托管尽调不到位

罚单显示,国融证券在三鼎控股公司债发行承销及受托管理工作中,对三鼎控股收购伟达置业相关事项尽职调查不到位,未勤勉尽责对有关重要报表项目履行审慎核查和必要的复核程序。

浙江证监局指出,国融证券应加强相关法律法规学习,严格遵守执业规范和监管规则,切实提升履职能力。公司应当在收到决定书之日起10个工作日内提交书面整改报告。

值得注意的是在上述公司债项目违规事件中,相关会计所及三鼎控股等也收到罚单。广东证监局同日披露的罚单显示,永拓会计所及注册会计师王永诗、刘青青、卢峥安被采取出具警示函措施。三鼎控股的法定代表人、董事长兼信息披露事务负责人丁志民被采取监管谈话措施,三鼎控股被采取出具警示函措施。

2025年:券商监管“大年”态势确立

2025年注定亦将是券商罚单大年。易董数据统计显示,9月30日,截至记者发稿,今年以来,监管向券商发布罚单超过259张,波及券商超过87家,罚单数量超过5张的券商有10家,被罚违规责任人数量超过248人。

出现次数较多的违规类型主要有,“尽职调查不规范”和“其他内控不规范”,均出现超过23次;借他人名义从事证券交易”,出现查过16次;“从业人员违规买卖证券”,出现超过11次。

出具警示函是较为常用的方式,“出具警示函”的处罚类型最为常见,接近170次,其次是“责令改正”(27次)、“行政处罚”(21次)、“监管谈话”(17次)等。