One month ago, the Bureau of Labor Statistics produced a jobs report so horrendous that Donald Trump took the unprecedented step of firing the BLS commissioner. On Friday, the bureau published its latest jobs report.

It was worse.

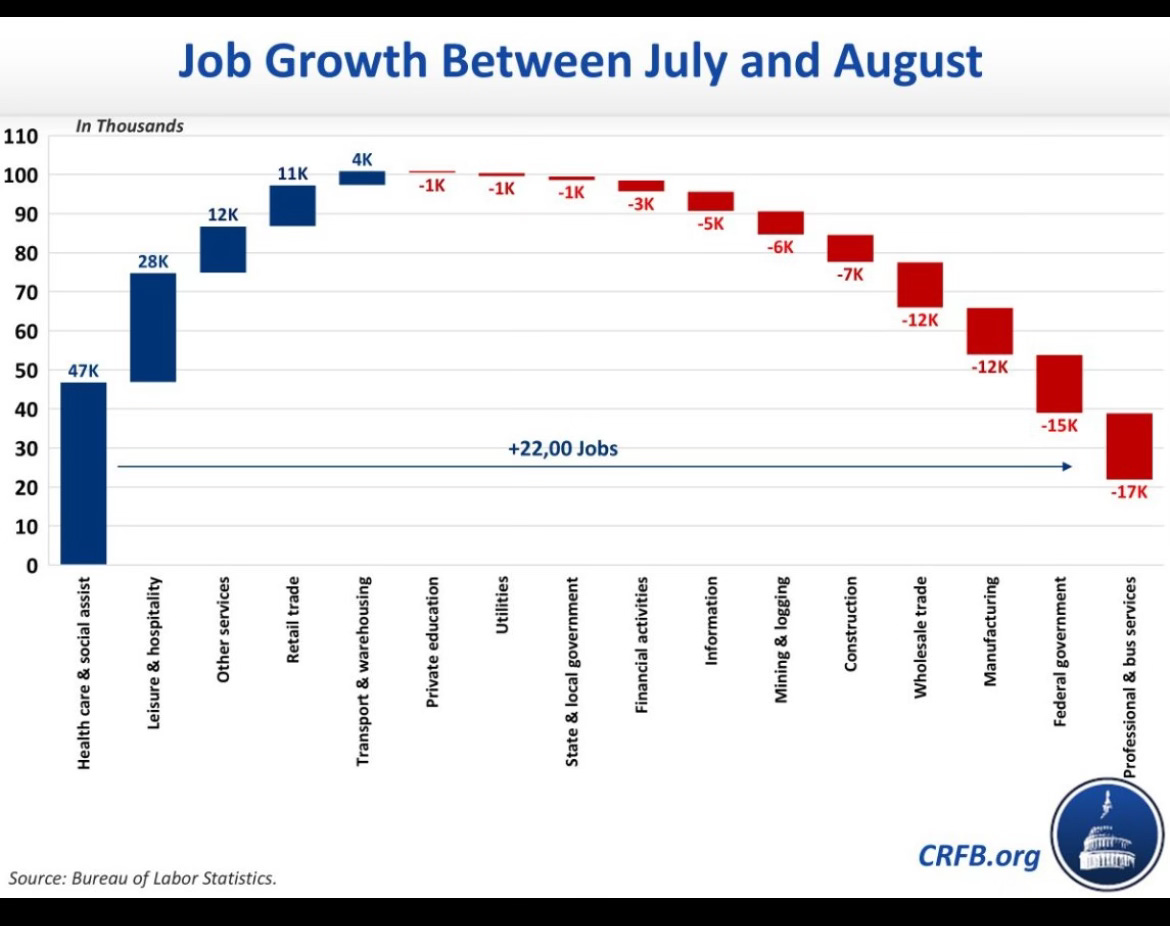

The economy added only 22,000 jobs in August. The unemployment rate rose slightly. Revised data showed that employment fell by 13,000 in June, the first decline since the pandemic, a classic warning sign of an economic slowdown.

In the spring, Trump’s 19th century throwback economics were billed as a way to help America build stuff, dig stuff, and save the common man. Remarkably, his policies are already achieving the opposite effect in every single way:

Manufacturing, construction, and mining jobs have all declined in the last three months, according to Heather Long, the chief economist at Navy Federal Credit Union. After the Liberation Day tariffs were announced, the MAGA leftist gadfly Batya Ungar-Sargon wrote that “Liberation Day Puts Main Street Ahead of Wall Street. Five months later, stocks are near all-time highs and unemployment is rising. “Trump’s tariffs make his commitment to America’s forgotten men and women clear,” the conservative think tanker Oren Cass wrote. Five months later, blue-collar job growth has nose-dived under Trump. The forgotten men and women are listing further toward oblivion.

The biggest reason why unemployment isn’t rising even faster is that two sectors—health care and what economists call social assistance (mostly personal and home health aides)—added nearly half of all net jobs in the last 12 months.

For months, the US economy has been twin-powered by the needs of the old and the dreams of the young. The big job drivers have been health care, especially social-assistance jobs such as home health aides. Meanwhile, the US economy last quarter was predominantly powered by infrastructure spending on AI, whose most quixotic developers believe they are “building god.”

The American economy is basically a Friday church service: Mostly old people and the attempt to summon the divine. That’s good news if you’re in the business of dialysis care or data center land acquisition. It’s bad news for just about everybody else.

The Road to Stagflation

In the 1960s, the politician Iain Macleod coined the term "stagflation" to describe the UK's combination of faltering growth and surging prices. Like British rock, stagflation crossed the Atlantic and hit the U.S. with hurricane force. Today the term typically refers to our 1970s economy, in which a series of oil crises shut down supply chains, slowed growth, and led to a period of painful inflation.

The first stagflation was imposed on America by outside forces. But imagine, hypothetically, that by some bizarre masochistic instinct, you wanted the US government to impose stagflation on its own country. What might you do in this totally hypothetical situation?

Well, maybe you would institute a legally dubious set of tariffs that immediately raised the price of all imports, including parts that manufacturers need to build things in the U.S. This would almost certainly raise the cost of durable goods, like cars and electronics. Meanwhile, if you really want to crush manufacturing, you might have the president change his mind on policy so frequently that banks and manufacturing firms couldn’t get together to invest in domestic plants. Then, maybe, you would announce the most restrictive immigration policy in modern history and turn the Immigration and Customs Enforcement department into an extralegal paramilitary force that raided farm workers, construction workers, and manufacturing plants. Altogether, this might be sufficient to push down growth while forcing up prices.

Of course, all of this is happening.

The cost of durable goods is rising. According to one analysis by the Yale Budget Lab, “core goods prices were 1.9 percent above the pre-2025 trend as of June, with window & floor coverings, appliances, and electronics particularly elevated.”

Manufacturing is in a recession. According to the respected Institute for Supply Management survey, the US manufacturing industry has contracted for six straight months. When the ISM recently asked manufacturers to explain why business was softening, the tariffs came up again, and again, and again:

Meanwhile, the population is quite possibly shrinking. As I wrote this week:

The math is straightforward. Population growth has two sources: natural increase (births minus deaths) and net immigration (arrivals minus departures). Last year, births outnumbered deaths by 519,000 people. That means any decline in net immigration in excess of half a million could push the U.S. into population decline. A recent analysis of Census data by the Pew Research Center found that between January and June, the US foreign-born population fell for the first time in decades by more than one million. While some economists have questioned the report, a separate analysis by the American Enterprise Institute predicted that net migration in 2025 could be as low as negative 525,000. In either case, annual population growth this year could easily turn negative.

Everything about these data points screams impending recession. Even so, recession isn’t inevitable. First, these policy wounds are largely self-inflicted, which means they can be un-self-inflicted. Second, the Federal Reserve can easily cut interest rates in a recessionary environment to stimulate investment.

It’s possible that the road to stagflation veers back toward growth. But growth is a policy choice. Trump has chosen differently.