Market Opportunity Analysis

Across the public sector, few data troves are as large and underutilized as unclaimed property records. In aggregate, the United States maintains $68+ billion in dormant assets scattered across 50+ state treasuries, quasi-government offices, and affiliated custodians. The result is a sprawling constellation of searchable ledgers: owner names, last-known addresses, financial institutions, amounts, date stamps, asset categories, and disposition codes. For data scientists, this looks like a long tail of messy but valuable signals. For product builders, it is a market that naturally rewards integration, normalization, identity resolution, and high-quality user experience. And for investors, it is a space with clear monetization paths: lead generation for wealth recovery services, premium matching accuracy for professionals, data products for compliance teams, and embedded claim workflows for fintechs and financial advisors.

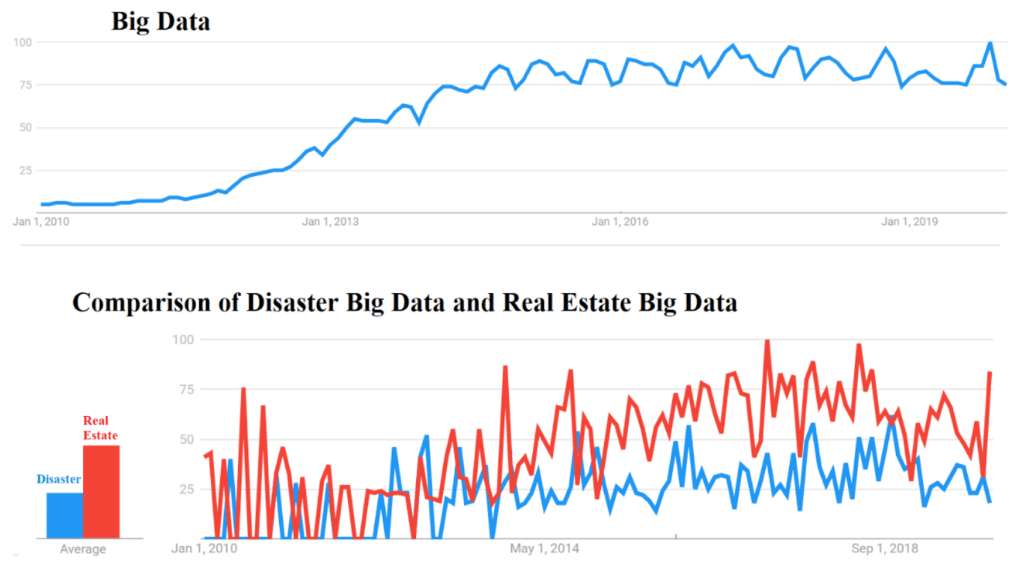

Figure. Rising big data momentum over the last decade, with domain volatility (disaster vs real estate) underscoring why $68B unclaimed property analytics is ripe for targeted insights.

The opportunity spans several industries. Fintech can surface proactive alerts inside banking apps when users are likely matched to dormant assets. Civic tech can build public-benefit tooling that increases claim rates while lowering administrative friction. Insurtech and asset managers can reduce escheatment by detecting at-risk accounts early. Even marketing and analytics teams can utilize these patterns to gain a deeper understanding of mobility, life events, and demographic behaviors associated with asset abandonment and recovery. Platforms like Claim Notify point to a pragmatic model: aggregate millions of records, unify schemas, and deliver consumer-grade search that transforms raw ledgers into clear answers.

Data Integration Technical Challenges

Schema standardization. Every state speaks a different dialect. Field names vary, types drift, and optional fields proliferate. One dataset may split first and last names; another might store a single free-text owner field. Address structures reflect legacy forms. A viable platform must map dozens of source schemas into a canonical model, with robust handling for nulls, multiple owners, corporate entities, and historical revisions.

API limitations. Some states offer rate-limited APIs with auth keys and variable paging; others have brittle endpoints prone to maintenance windows. Several provide search-only interfaces with limited export features. Orchestration has to account for backoff, jitter, token refresh, and auto-recovery from partial pulls.

Data quality variations. Expect typos, stale addresses, truncated names, and inconsistent date formats. Proven pipelines lean on deterministic rules plus probabilistic matching to reconcile duplicates, merge near matches, and score confidence per candidate.

Real-time processing. Keeping data current is nontrivial because states update on different cadences. Effective systems schedule incremental pulls, diff the new against the warehouse, and propagate deltas through downstream indexes. Platforms like Claim Notify have adopted resilient ingestion and change-data processing to keep search results fresh without hammering fragile sources.

Machine Learning Applications

Pattern recognition. Unsupervised methods can cluster abandonment signatures: employer changes, interstate moves, or banking churn. These clusters help forecast where unclaimed assets will emerge and which cohorts are most likely to recover them.

Fraud detection. Supervised classifiers, anomaly detection, and graph analytics can flag suspicious claiming patterns, such as repeated attempts across many small accounts or identity attributes that fail cross-checks. Risk scores route high-risk cases to manual review without degrading honest user experience.

Predictive modeling. Gradient boosting or generalized additive models can estimate the probability that a match is genuine and that a user will complete a claim once started. Prioritization improves when the model pairs data signals with behavioral telemetry from the search interface.

Natural language processing. Fuzzy name matching benefits from phonetic encodings, transliteration support, nickname dictionaries, and address normalization. NLP also assists with deduping corporate entities, parsing line noise in legacy fields, and reconciling variant spellings.

Behavioral analytics. Funnel analysis quantifies where users drop off. If most abandon documentation upload, the fix is UX and education. If the issue is comprehension, in-flow guidance reduces confusion. This is where platforms like Claim Notify turn ML insight into UX impact.

ROI and Investment Analysis

The economics are attractive. On the cost side, engineering investment flows to data connectors, schema mapping, ML pipelines, and identity resolution. On the revenue side, viable models include premium search for power users, B2B access for professionals, embedded recovery services, and partner integrations. Governments save on support costs when claimants self-serve successfully. Financial advisors and fintechs increase customer satisfaction by helping reunite clients with assets. Venture capital interest follows where there is recurring value and defensible data moats. With millions of records and frequent updates, network and data effects accrue to teams that continually improve matching accuracy and UX.

Future Applications

Expansion to adjacent verticals. Property tax auctions, court-ledger refunds, class-action distributions, and uncashed payroll checks share similar data DNA. The same ETL and ML stack can extend horizontally.

Blockchain for provenance. Immutable audit trails could improve chain-of-custody for claims, but interoperability and privacy constraints must be solved first. Expect hybrid models that anchor proofs while keeping PII off-chain.

AI-driven notifications. With user consent, models can monitor life events that correlate with escheatment risk and proactively notify users before their assets go dormant.

Fintech embedding. Banks and wealth platforms can add a white-label search that checks for unclaimed assets during onboarding or annual reviews. This positions recovery as part of a holistic approach to financial health.

Call to Action

For data leaders, the playbook is clear: build a robust integration layer, treat data quality as a product, and pair ML with humane UX. For policymakers and partners, collaborate with private platforms that can turn scattered ledgers into outcomes. If you want a working reference architecture already helping people find money they are owed, explore how Claim Notify operationalizes these ideas at a consumer scale.

The post Mining Government Gold: Big Data Opportunities in the $68 Billion Unclaimed Property Market appeared first on Big Data Analytics News.