Federal Reserve Chairman Jerome Powell made the kind of headlines this week that give stock brokers ulcers. After a speech in Rhode Island on Tuesday, the central banker was asked about frothiness in the markets. As Fortune‘s Jim Edwards reported, his reply contained six words that investors didn’t want to hear: “Equity prices are fairly highly valued.” The S&P 500 fell 0.55% on Tuesday and another 0.28% on Wednesday. Still, that’s after a string of record highs throughout the summer.

Bank of America Research followed with a particularly well-time research note on the S&P 500 and its soaring valuations, declaring that the benchmark index is trading at “statistically expensive levels” on 19 out of 20 key metrics. Four of these valuation metrics have just reached all-time highs, noted the team led by Savita Subramanian, head of U.S. equity strategy.

On virtually all widely observed valuation gauges, Subramanian’s S&P 500 Relative Value Cheat Sheet found a wildly inflated index. The four record metrics are noteworthy. First is the index’s Price-to-Book Value ratio, which has surged to 5.37x, nearly double its historical average of 2.75x. The Market Cap-to-GDP ratio—a popular Warren Buffett indicator—has also climbed to a record 1.8x, far outpacing its typical average of 0.69x. The Price-to-Operating Cash Flow and Enterprise Value to Sales metrics also pressed new peaks, underscoring the unprecedented enthusiasm among investors.

“Buying stocks at these multiples feels bad,” Subramanian wrote in her note, adding that there are good and bad ways “to resolve this seemingly untenable situation.”

A structural or temporary shift?

This feverish pricing has left many market participants wondering if these levels signal the approach of a bubble or reflect profound changes within the composition and business models of the index.

“Perhaps this situation is not untenable,” Subramanian writes, noting the index has evolved considerably since earlier decades. She returned to a thesis about the modern being markedly more asset- and labor-light, with technology, communications, and health care making up a significant portion. Companies are less levered and more predictable, with 80% of S&P 500 debt now fixed and long-term, compared to just 44% in 2007. “Perhaps we should anchor to today’s multiples as the new normal rather than expecting mean reversion to a bygone era.”

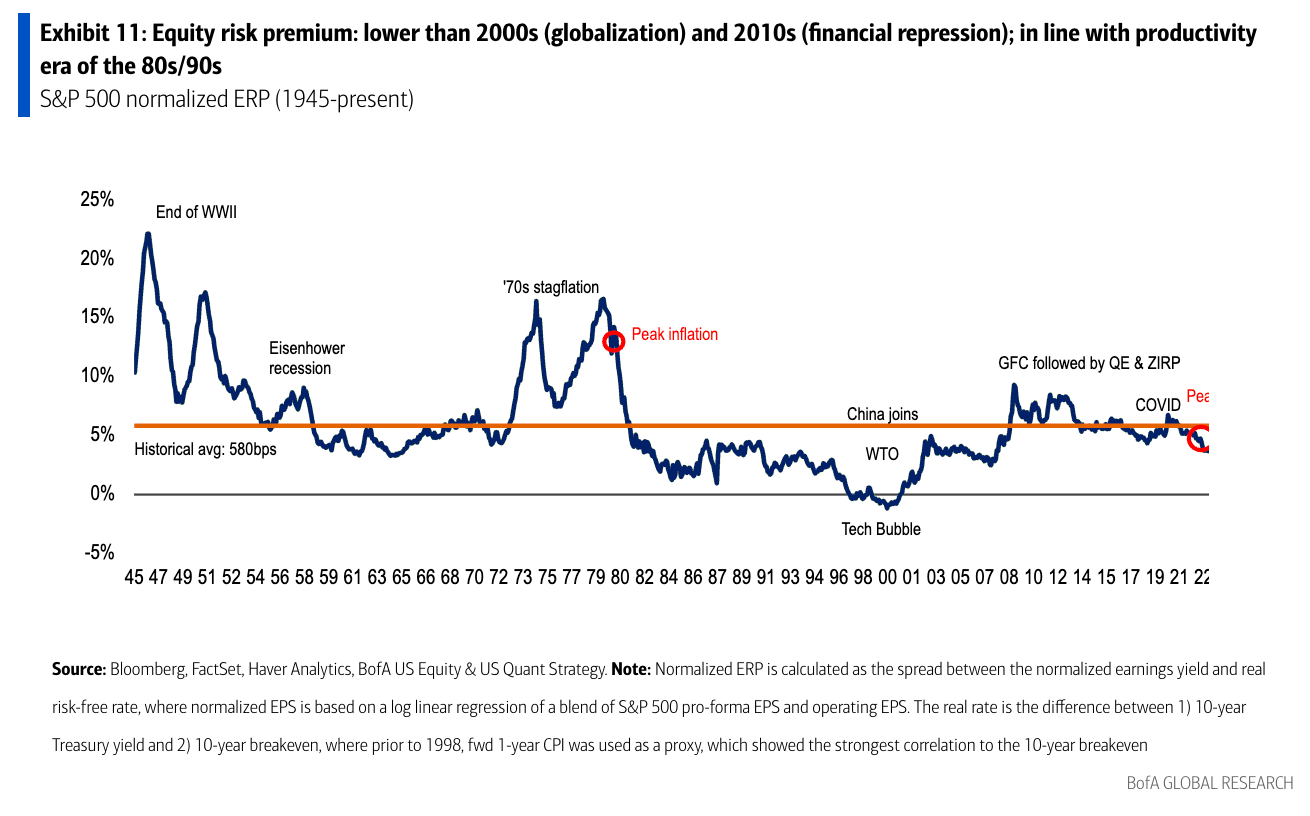

Subramanian told Fortune in August that a boost in worker productivity may finally be kickstarting a revolution in equities, and it has to do with this asset-light structure. To that point, the cheat sheet a month later argues that frothy valuations could be justified if an earnings boom materializes, helping the index “grow into” its multiples. History shows that price-to-earnings ratios can compress in two ways: either stock prices fall or corporate profits rise. With broadening profitability, innovations in automation and AI, and persistent fiscal support across major economies, an earnings surge in 2025 and beyond is not out of the question. Should profits outpace expectations, the current valuations could be justified, softening the risks of a sharp reversal. Still, according to Subramanian, there is a “valuation problem” in equities right now.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.

returns Oct. 26–27, 2025 in Riyadh. CEOs and global leaders will gather for a dynamic, invitation-only event shaping the future of business.

Apply for an invitation.