Good morning. Verizon sees AI not just as a tool to boost efficiency but as a potential new revenue engine.

I recently spoke with Verizon CFO Tony Skiadas, who discussed how the company is working to repurpose parts of its wireline network to support AI workloads and what that could mean for Verizon’s future.

Reimagining wireline for AI

Skiadas explained that Verizon (No. 30 on the Fortune 500) is testing ways to leverage its existing central offices—facilities largely freed up as copper networks are replaced by fiber—for AI processing power at the edge.

“Fiber takes up a fraction of the space compared with the old copper network,” Skiadas told me. That frees up facilities equipped with space, power, and cooling—exactly what’s needed to handle AI workloads at scale, he said.

The initiative, internally called Verizon AI Connect, centers on repurposing those assets rather than selling them. According to Skiadas, the combination of facilities and fiber positions Verizon to serve hyperscalers—large tech companies requiring custom AI infrastructure—with unique value. The company might have to spend some capital on its facilities, but it already has many of the assets in place to deliver these workloads at scale, he said.

“This is probably a medium- to long-term exercise,” he noted, “because every deal is highly customized.” Skiadas added: “But I like what I’m seeing from a sales funnel perspective. We talked about a billion-dollar sales funnel at the beginning of the year, and that’s actually doubled in terms of potential opportunity.”

While some smaller agreements could materialize this year, larger deals will take more time due to the complexity of building fiber or upgrading facilities, Skiadas explained. “It’s not a flip-the-switch thing,” he said. But the current level of demand is encouraging and will help guide where the company invests, he added.

AI inside Verizon

Beyond customer offerings, Verizon is also using AI internally to improve efficiency and service, Skiadas said. He pointed to AI-driven personalization in its customer plans, tools that help support agents find answers faster, and network optimization powered by machine learning.

AI is making Verizon’s customer care both more efficient and more effective, he said. “The customer is not waiting for 10 or 15 minutes for an answer.” Verizon is also applying AI in its network and across back-office functions to improve forecasting, accuracy, and decision-making, he added.

“I’m pushing my own team on this, too, to continue to innovate,” Skiadas said. “I even use it myself for simple things.” For example, he uses it to digest reports and summarize documents. “It’s a time saver for me,” he said. “And I tell people, if I can use it, anybody can. So that’s my motivation to my team.”

Regarding the ROI of AI: “I think it’s going to take time,” Skiadas said. Some benefits, like productivity gains in customer care, are easy to quantify, while others—such as efficiency improvements in finance or better decision making—are harder to measure directly. The true measure, he emphasized, is how effectively Verizon employees can make forward-looking decisions. Ultimately, Skiadas sees the value of AI less in looking backward and more in improving forecast accuracy, guiding decisions, and enabling employees to focus on higher-value work.

I asked Skiadas what he thinks makes Verizon stand out among its competitors. Over the past seven years, Verizon has invested about $200 billion in wireless spectrum and networks—spending roughly $17–18 billion annually—to continually strengthen its network, Skiadas said.

“That’s really the hallmark of our company, and then giving customers choice and flexibility,” he said.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Raja Dakkuri, EVP and CFO of Cohen & Steers, Inc. (NYSE: CNS), has decided to resign from the company effective Oct. 17 after accepting another opportunity. Cohen & Steers has appointed Michael Donohue, SVP and controller, as interim CFO. The company has begun a search, considering both internal and external candidates, to find a permanent successor.

Hashim Ahmed has been appointed CFO of New Found Gold Corp. (NYSE-A: NFGC), effective immediately. Current CFO Michael Kanevsky will assist with the transition. Ahmed brings 25 years of experience, most recently serving as EVP and CFO at Mandalay Resources Corp., prior to its acquisition by Alkane Resources Ltd. He has also held CFO roles at Nova Royalty Corp. and Jaguar Mining Inc., and spent seven years at Barrick Gold Corp.

Big Deal

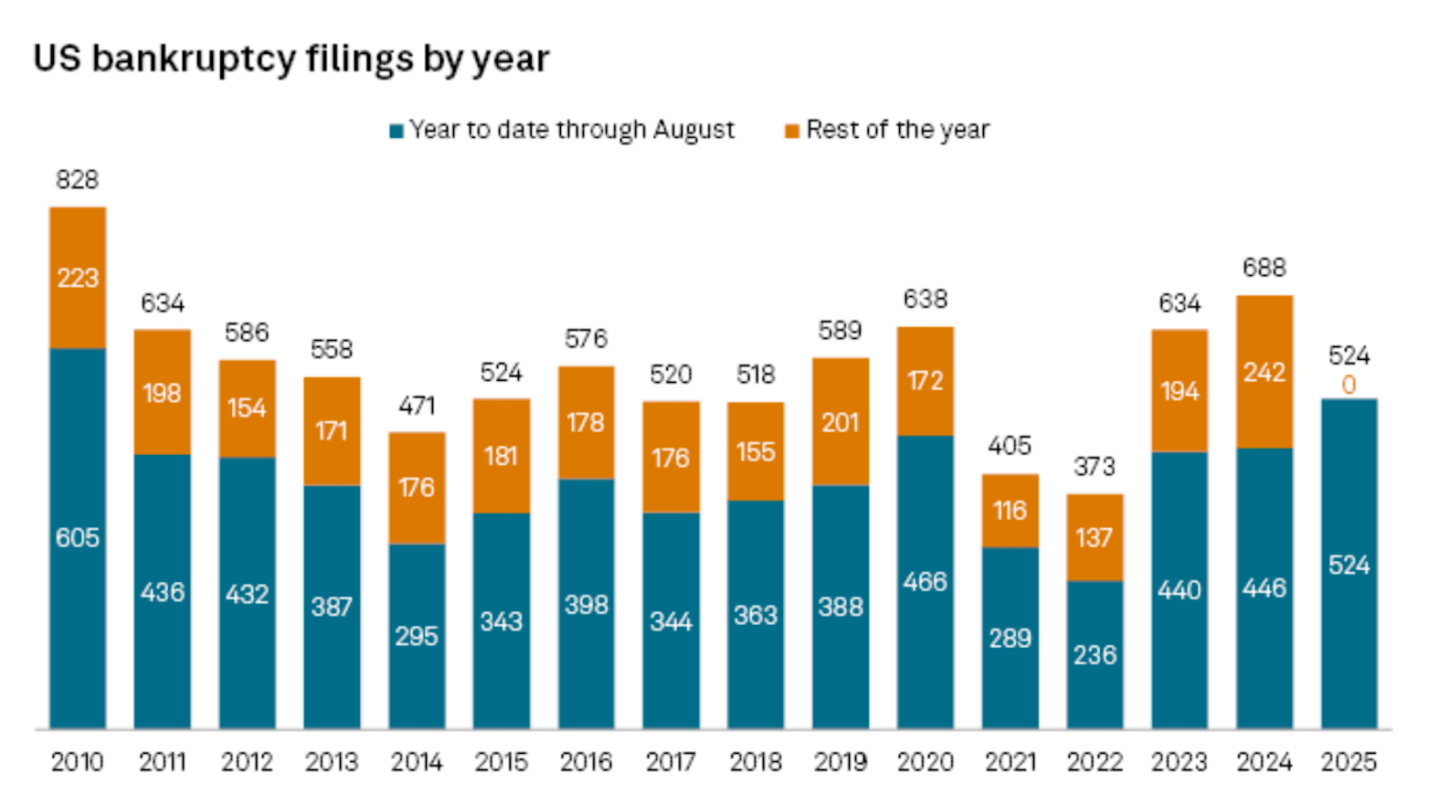

U.S. corporate bankruptcies climbed for a fourth straight month in August, according to S&P Global Market Intelligence data. Filings by large public and private companies rose to 76 from 71 in July. Year-to-date, 524 companies have filed through August, the most for the period since 2010. The data includes companies with public debt and assets or liabilities of at least $2 million or private companies with assets or liabilities of at least $10 million at the time of filing.

U.S. corporations reduced debt in the second quarter, according to S&P Global Market Intelligence, and could see further relief in the months ahead as the Federal Reserve is expected to resume cutting interest rates. "However, the impact from these cuts may be limited if yields for mid-dated and long-dated Treasurys do not decline alongside the Fed's easing monetary policy," the report states.

Going deeper

"Trump wants to end a half-century-old mandate on how companies report earnings" is a Fortune report by Nino Paoli.

From the report: "In a Truth Social post on Monday, President Trump said companies should instead only be required to post earnings every six months, pending the U.S. Securities and Exchange Commission’s approval. This change would break a quarterly reporting mandate that’s been in place since 1970. 'This will save money, and allow managers to focus on properly running their companies,' Trump wrote. He added that China has a '50 to 100 year view on management of a company,' as opposed to U.S. companies required to report four times in a fiscal year. China’s Hong Kong Stock Exchange allows companies to submit voluntary quarterly financial disclosures, but only requires them to report their financial results twice a year."

Overheard

"A well-designed digital identity system doesn’t just verify that you are who you say you are. It also protects your ability to limit what you reveal."

—Will Wilkinson, director of government affairs for identity provider Persona, writes in a Fortune opinion piece titled, "America needs a digital identity strategy."

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance.

Sign up for free.