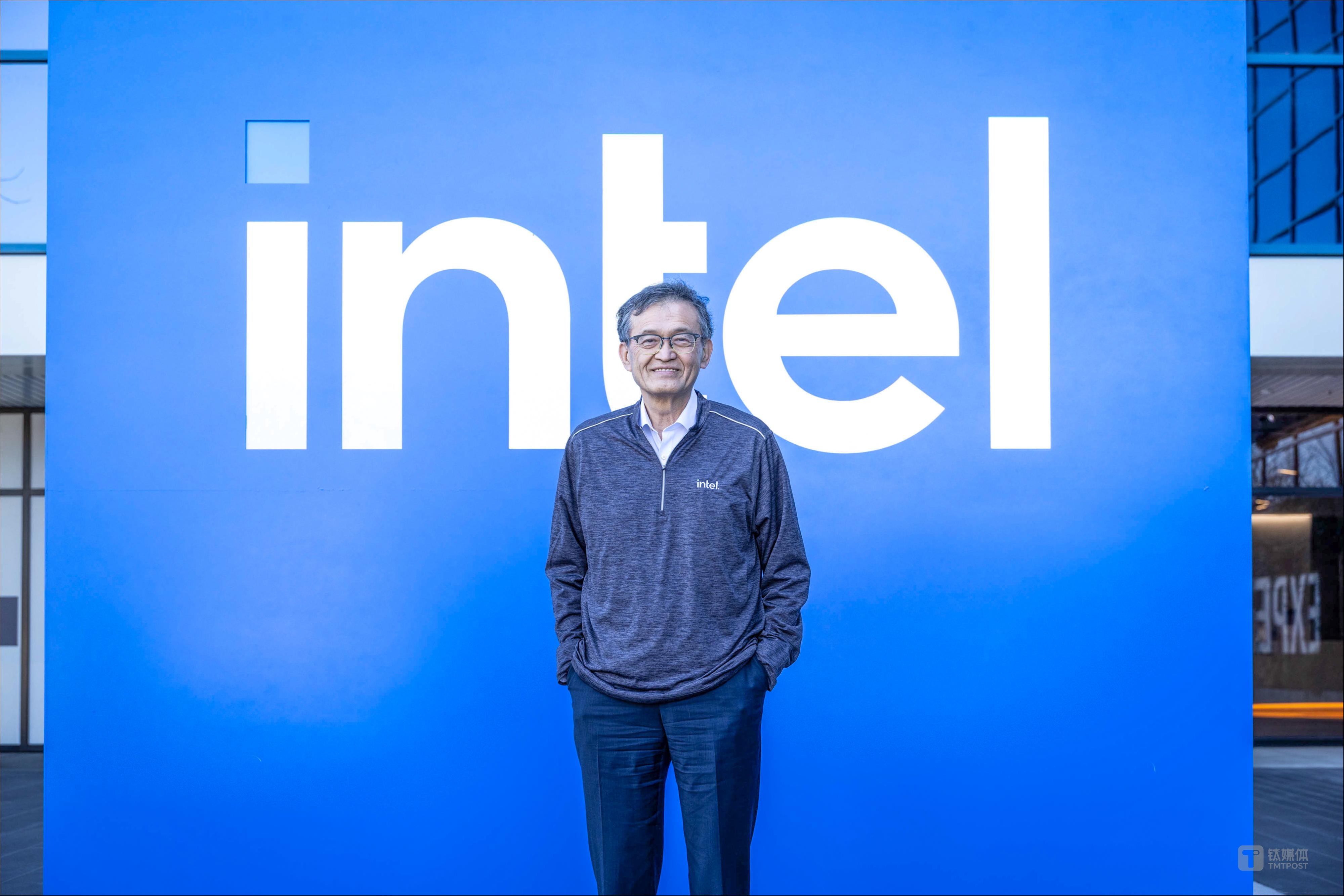

Intel CEO Lip-Bu Tan

AsianFin — In a remarkable turn of events, U.S. President Donald Trump has reversed his public stance on Intel CEO Lip-Bu Tan, a move that highlights the deep anxieties and political tensions swirling around the U.S. semiconductor industry.

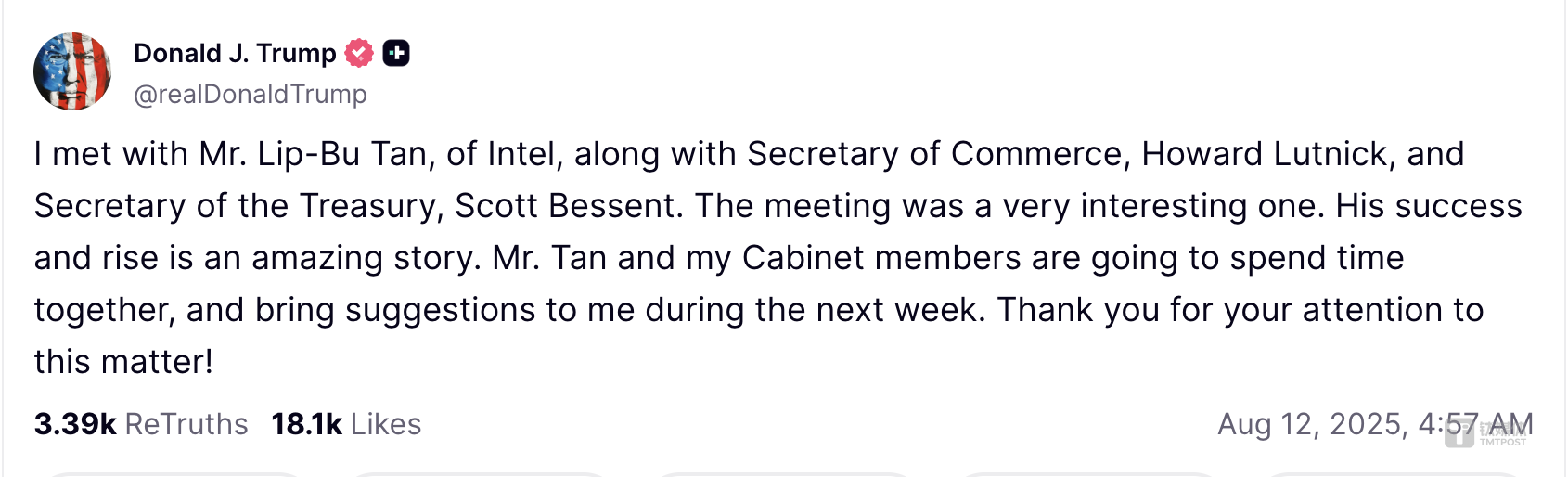

Just days after calling for Tan's immediate resignation, Trump posted on his social media platform, Truth Social, that he had a "meaningful" meeting with the CEO and other officials, praising Tan's "remarkable stories."

The initial demand for Tan’s removal, which stemmed from vague accusations of a "serious conflict of interest," ignited a firestorm of speculation and drew widespread commentary from industry experts. The central issue at hand is not just a political spat, but a reflection of the U.S.'s declining position in global advanced chip manufacturing.

The Broader Context: A Fading American Dominance

This dramatic episode has thrust Intel, a company once synonymous with American technological supremacy, into the center of a national debate. The Wall Street Journal framed the incident as a litmus test for the U.S. chip sector, which has been in a slow, steady decline for decades. According to data from the U.S. Semiconductor Industry Association, America's share of global chip production has plummeted from 37% in 1990 to just 12% today. This stands in stark contrast to Asia, which now accounts for a staggering 75% of global manufacturing, led by giants like TSMC and Samsung.

Intel, once the world's most valuable semiconductor company, has seen its own market capitalization halved since the beginning of last year. It has struggled with a series of failed acquisitions and strategic missteps, particularly its inability to gain a foothold in the smartphone chip market. The company’s manufacturing technology has reportedly fallen more than two generations behind its competitors. A significant portion of Intel’s chip wafers are now manufactured externally, a trend that is only growing.

Tan, a veteran of the semiconductor industry, took the helm as Intel’s ninth CEO in March 2025. He replaced Pat Gelsinger, who had also faced scrutiny for his leadership decisions. Gelsinger's tenure was marked by a push for cost-cutting and a massive global layoff of 20,000 employees, which put him at odds with the "America First" agenda.

Tan, like Gelsinger, is now navigating the difficult path of reviving the struggling giant. His background has made him a target for political scrutiny. As the founder of the venture capital firm Walden International, Tan has a history of investing in numerous technology companies, including an early stake in SMIC, a major Chinese semiconductor foundry. This has led to accusations of "China ties" from political figures like Senator Tom Cotton, who questioned if his leadership could compromise U.S. national security.

In a letter to employees, Tan directly addressed the accusations, emphasizing his deep commitment to the United States. "Leading Intel at this critical moment is not just a job—it is an honor," he wrote, framing the company's success as vital to America's "national security" and "economic strength."

A Battle Over Strategy

The political pressure comes at a time of internal division over Intel's strategic direction. The company has long adhered to an Integrated Device Manufacturing (IDM) model, designing and manufacturing its own chips. However, with its foundry business operating at a loss, some, including former board chairman Frank Yeary, have proposed spinning off the manufacturing arm or even selling it to rivals like TSMC.

Tan's predecessor, Pat Gelsinger, had championed the foundry business as crucial to ensuring the U.S. remained independent of foreign manufacturers. However, Gelsinger's decision to scale back investments in new factories in Germany, Poland, and Ohio further complicated his relationship with a government pushing for more domestic production.

For now, the capital markets remain cautious but hopeful. Despite the political noise and a disappointing Q2 earnings report, Intel's stock saw a modest increase. However, the path forward is anything but clear.

The saga of Tan and Trump is a vivid illustration of the broader challenges facing Intel and the U.S. chip industry as a whole—a battle not just for market share, but for national pride and technological sovereignty.

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App